Business, 27.02.2020 17:40, genyjoannerubiera

The bank is working to develop an efficient work schedule for full-time and part-time tellers. The schedule must provide for efficient operation of the bank including adequate customer service, employee breaks, and so on. On Fridays the bank is open from 9:00 A. M. to 7:00 P. M. The number of tellers necessary to provide adequate customer service during each hour of operation is summarized here.

Time Number of Tellers Time Number of Tellers

9:00 a. m.-10:00 a. m. 6 2:00 p. m.-3:00 p. m. 6

10:00 a. m.-11:00 a. m. 4 3:00 p. m.-4:00 p. m. 4

11:00 a. m.-Noon 8 4:00 p. m.-5:00 p. m. 7

Noon-1:00 p. m. 10 5:00 p. m.-6:00 p. m. 6

1:00 p. m.-2:00 p. m. 9 6:00 p. m.-7:00 p. m. 6

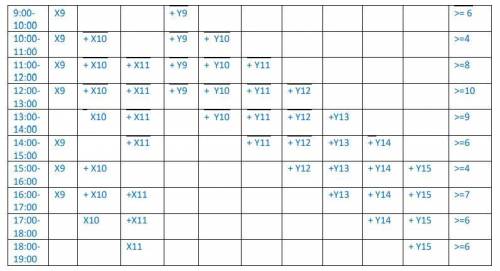

Each full-time employee starts on the hour and works a 4-hour shift, followed by a 1-hour break and then a 3-hour shift. Part-time employees work one 4-hour shift beginning on the hour. Considering salary and fringe benefits, full-time employees cost the bank $15 per hour ($105 a day), and part-time employees cost the bank $8 per hour ($32 per day).

Required:

Formulate an integer programming model that can be used to develop a schedule that will satisfy customer service needs at a minimum employee cost. (Hint: Let xi = number of full-time employees coming on duty at the beginning of hour i and yi = number of part-time employees coming on duty at the beginning of hour i.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:50, vcornejo7

Seattle bank’s start-up division establishes new branch banks. each branch opens with three tellers. total teller cost per branch is $96,000 per year. the three tellers combined can process up to 90,000 customer transactions per year. if a branch does not attain a volume of at least 60,000 transactions during its first year of operations, it is closed. if the demand for services exceeds 90,000 transactions, an additional teller is hired and the branch is transferred from the start-up division to regular operations. required what is the relevant range of activity for new branch banks

Answers: 2

Business, 22.06.2019 08:30, shauntleaning

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

Business, 22.06.2019 09:40, MileenaKitana

Wilson center is a private not-for-profit voluntary health and welfare entity. during 2017, it received unrestricted pledges of $638,000, 65 percent of which were payable in 2017, with the remainder payable in 2018 (for use in 2018). officials estimate that 14 percent of all pledges will be uncollectible. a. how much should wilson center report as contribution revenue for 2017? b. in addition, a local social worker, earning $20 per hour working for the state government, contributed 600 hours of time to wilson center at no charge. without these donated services, the organization would have hired an additional staff person. how should wilson center record the contributed service?

Answers: 2

Business, 22.06.2019 16:50, taylorb9893

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

Do you know the correct answer?

The bank is working to develop an efficient work schedule for full-time and part-time tellers. The s...

Questions in other subjects:

Biology, 19.05.2020 21:05