Business, 27.02.2020 01:12, Crtive6538

General Inc. shipped 100 million coupons in products it sold in 2013. The coupons are redeemable for thirty cents each. General anticipates that 70% of the coupons will be redeemed. The coupons expire on December 31, 2014. There were 45 million coupons redeemed in 2013, and 30 million redeemed in 2014.

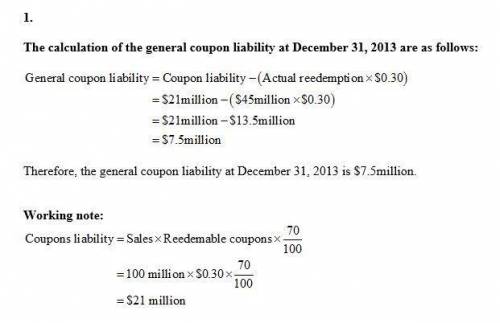

1. What was Gerneral`s coupon liability as of December 31, 2013?

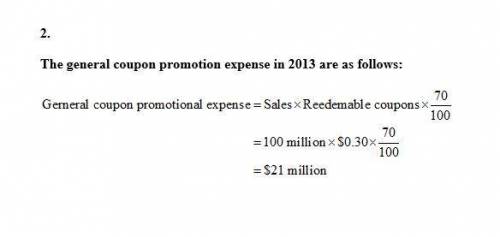

2.What was General`s coupon promotion expense in 2013?

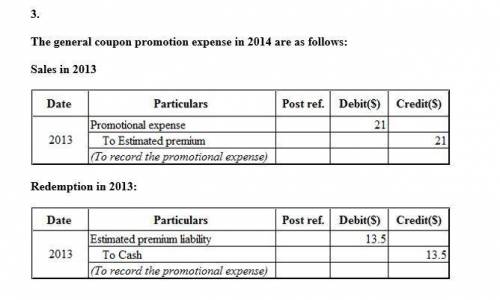

3. What was Gerneral`s coupon promotional expense in 2014?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:00, emwemily

Frolic corporation has budgeted sales and production over the next quarter as follows. the company has 4100 units of product on hand at july 1. 10% of the next months sales in units should be on hand at the end of each month. october sales are expected to be 72000 units. budgeted sales for september would be: july august september sales in units 41,500 53,500 ? production in units 45,700 53,800 58,150

Answers: 3

Business, 22.06.2019 16:50, bri663

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Do you know the correct answer?

General Inc. shipped 100 million coupons in products it sold in 2013. The coupons are redeemable for...

Questions in other subjects:

Mathematics, 26.08.2019 07:50

Mathematics, 26.08.2019 07:50

Social Studies, 26.08.2019 07:50

Biology, 26.08.2019 07:50

English, 26.08.2019 07:50

Biology, 26.08.2019 07:50