Business, 26.02.2020 03:53, Gabriel134

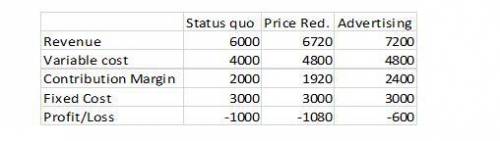

Your regular price is $30/unit, unit variable cost is $20/unit and fixed costs are $3,000 per month. Because of the recession, your sales have dropped to 200 units a month, so you are losing money. You are considering two options to increase sales:

(1) reduce the price to $28/unit, or

(2) run an advertising campaign, which will cost you $300 a month, but keep the price at $30/unit.

In both scenarios, you estimate that sales will increase by 20%, from 200 to 240 units per month.

Required:

a) Compute total revenues, costs and profits under the status quo (original situation), and for each of the two new options.

b) Based on your results in (a), what should you do: do nothing, reduce the price or run the advertising campaign?

(enter 1 for "do nothing", 2 for "reduce price", 3 for "advertising")

c) If you solved (a) and (b) correctly, you are still losing money despite choosing the best option. Should you shut down your business in the short term? Explain why or why not.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:50, kyliegriffis

He taylor company sells music systems. each music system costs the company $100 and will be sold to the public for $250. in year one, the company sells 100 gift cards to customers for $250 each ($25,000 in total). these cards are valid for just one year, and company officials expect them to all be redeemed. in year two, only 96 of the cards are returned. what amount of net income does the company report for year two in connection with these cards? a. $15,000b. $15,400c. $15,500d. $15,800

Answers: 1

Business, 22.06.2019 01:00, Reddolls

You are the manager in charge of global operations at bankglobal – a large commercial bank that operates in a number of countries around the world. you must decide whether or not to launch a new advertising campaign in the u. s. market. your accounting department has provided the accompanying statement, which summarizes the financial impact of the advertising campaign on u. s. operations. in addition, you recently received a call from a colleague in charge of foreign operations, and she indicated that her unit would lose $8 million if the u. s. advertising campaign were launched. your goal is to maximize bankglobal’s value. should you launch the new campaign? explain. pre-advertising campaign post-advertising campaign total revenues $18,610,900 $31,980,200 variable cost tv airtime 5,750,350 8,610,400 ad development labor 1,960,580 3,102,450 total variable costs 7,710,930 11,712,850 direct fixed cost depreciation – computer equipment 1,500,000 1,500,000 total direct fixed cost 1,500,000 1,500,000 indirect fixed cost managerial salaries 8,458,100 8,458,100 office supplies 2,003,500 2,003,500 total indirect fixed cost $10,461,600 $10,461,600

Answers: 2

Do you know the correct answer?

Your regular price is $30/unit, unit variable cost is $20/unit and fixed costs are $3,000 per month....

Questions in other subjects:

Mathematics, 27.03.2020 04:59

Mathematics, 27.03.2020 05:07

History, 27.03.2020 05:07