Business, 22.02.2020 02:07, venancialee8805

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2014, and mature January 1, 2019, with interest payable December 31 of each year. Aumont Company allocates interest and unamortized discount or premium on the effective-interest basis.

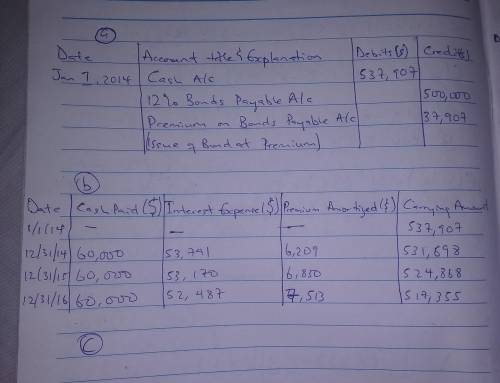

(a) Prepare the journal entry at the date of the bond issuance. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

January 1, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(b) Prepare a schedule of interest expense and bond amortization for 2014?2016. (Round answers to 0 decimal places, e. g. 38,548.)

Schedule of Interest Expense and Bond Premium Amortization

Effective-Interest Method

Date

Cash

Paid

Interest

Expense

Premium

Amortized

Carrying

Amount of Bonds

1/1/14 $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds

12/31/14 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/15 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/16 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

(c) Prepare the journal entry to record the interest payment and the amortization for 2014. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(d) Prepare the journal entry to record the interest payment and the amortization for 2016. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2016

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 13:40, deezzzy

After much consideration, you have chosen cancun over ft. lauderdale as your spring break destination this year. however, spring break is still months away, and you may reverse this decision. which of the following events would prompt you to reverse this decision? a. the marginal cost of going to cancun decreases. b. the marginal cost of going to ft. lauderdale decreases. c. the marginal benefit of going to cancun increases. d. the marginal benefit of going to ft. lauderdale decreases.

Answers: 2

Business, 22.06.2019 15:00, WowOK417

Which of the following characteristics are emphasized in the accounting for state and local government entities? i. revenues should be matched with expenditures to measure success or failure of the government entity. ii. there is an emphasis on expendability of resources to accomplish objectives. a. i only b. ii only c. i and ii d. neither i nor ii

Answers: 2

Business, 22.06.2019 19:40, jair512872

Lauer corporation uses the periodic inventory system and has provided the following information about one of its laptop computers: date transaction number of units cost per unit 1/1 beginning inventory 210 $ 910 5/5 purchase 310 $ 1,010 8/10 purchase 410 $ 1,110 10/15 purchase 255 $ 1,160 during the year, lauer sold 1,025 laptop computers. what was cost of goods sold using the lifo cost flow assumption?

Answers: 1

Do you know the correct answer?

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907,...

Questions in other subjects:

Mathematics, 12.12.2020 16:20

Biology, 12.12.2020 16:20

English, 12.12.2020 16:20

Mathematics, 12.12.2020 16:20