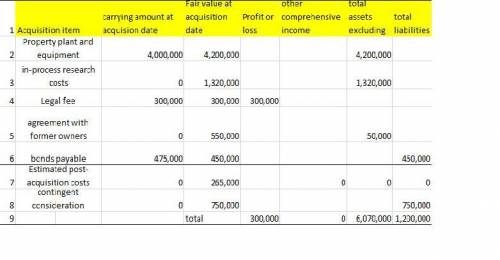

FB Corp. prepares its financial statements in accordance with IFRS. FB acquired 100% of the outstanding common stock of Skarlet, Inc. for $5,500,000. The purchase price included $300,000 to reimburse the former shareholders of Skarlet for legal fees incurred to complete the acquisition. The company also agreed to pay the seller an additional $1,500,000 if Skarlet generated $5,000,000 in net earnings during the first two years after the acquisition. At the acquisition date, the fair value of the contingent consideration was $750,000.

For each of the acquisition items, enter the amount that should be reflected in the line item of FB's consolidated financial statements as of the acquisition date. Enter debit balances as positive values and credit balances as negative values. If an item is not included in any line item, enter zeros in each cell of the associated row.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 16:50, bandzlvr

Andrea cujoli is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market. currently the spot price for the japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$. andrea would earn a higher rate of return by buying yen and a forward contract than if she had invested her money in 6-month us treasury securities at an annual rate of 2.50%. true/false?

Answers: 2

Business, 22.06.2019 17:30, leannhb3162

Aproject currently generates sales of $14 million, variable costs equal 50% of sales, and fixed costs are $2.8 million. the firm’s tax rate is 40%. assume all sales and expenses are cash items. (a). what are the effects on cash flow, if sales increase from $14 million to $15.4 million? (input the amount as positive value. enter your answer in dollars not in (b) what are the effects on cash flow, if variable costs increase to 60% of sales? (input the amount as positive value. enter your answers in dollars not in millions). cash flow (increase or decrease) by $

Answers: 2

Business, 22.06.2019 20:40, mom1645

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

Business, 22.06.2019 22:40, songulakabulut1992

Which of the following will not cause the consumption schedule to shift? a) a sharp increase in the amount of wealth held by households b) a change in consumer incomes c) the expectation of a recession d) a growing expectation that consumer durables will be in short supply

Answers: 1

Do you know the correct answer?

FB Corp. prepares its financial statements in accordance with IFRS. FB acquired 100% of the outstand...

Questions in other subjects:

Biology, 08.05.2021 08:30

Chemistry, 08.05.2021 08:30

Mathematics, 08.05.2021 08:30

Chemistry, 08.05.2021 08:30

Mathematics, 08.05.2021 08:30