Business, 20.02.2020 08:29, lexibyrd120

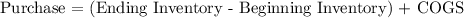

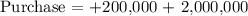

Dave's Duds reported cost of goods sold of $2,000,000 this year. The inventory account increased by $200,000 during the year to an ending balance of $400,000. What was the cost of merchandise that Dave's purchased during the year? a. $2,200,000 b. $2,400,000 c. $1,800,000 d. $1,600,000

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:50, jadeafrias

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 11:00, igtguith

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 22.06.2019 15:10, emilypzamora11

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 20:00, nestergurl101

With the slowdown of business, how can starbucks ensure that the importance of leadership development does not get overlooked?

Answers: 3

Do you know the correct answer?

Dave's Duds reported cost of goods sold of $2,000,000 this year. The inventory account increased by...

Questions in other subjects:

History, 25.05.2021 22:00

Biology, 25.05.2021 22:00

Health, 25.05.2021 22:00

Mathematics, 25.05.2021 22:00