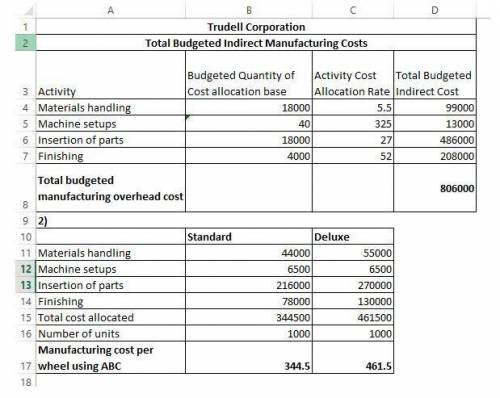

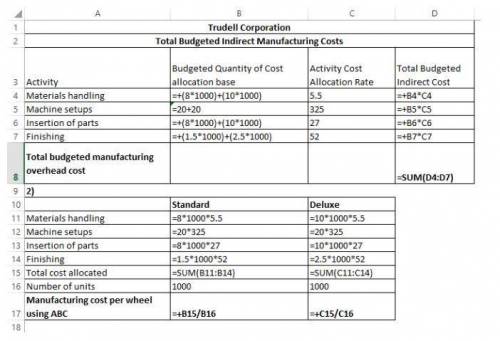

Activity Cost Activity Allocation Base Allocation Rate

Materials. handling. Number of...

Business, 20.02.2020 06:43, baleycardell9901

Activity Cost Activity Allocation Base Allocation Rate

Materials. handling. Number of parts $ 5.50 per part

Machine setup. Number of setups $ 325.00 per setup

Insertion of parts. Number of parts $ 27.00 per part

Finishing Finishing direct labor hours $ 52.00 per hour

Standard Deluxe

Parts per .wheel 8.0 Tallo J VI I . . . . . . . . . . . . . . . . . 10.0 20.0

Setups per 1,000 wheels 20.0

Finishing. direct. labor hours per wheel 1.5 2.5

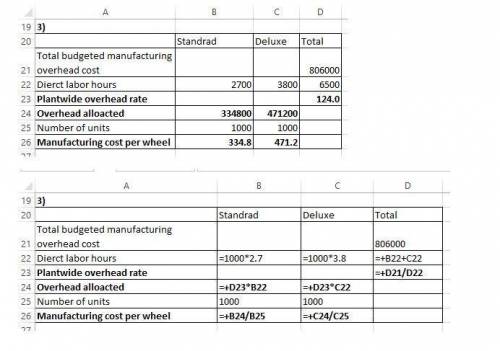

Total .direct labor. hours. per. wheel 2.7 - 3.8

The company's managers expect to produce 1,000 units of each model during the year.

1. Compute the total budgeted manufacturing overhead cost for the upcoming year.

2. Compute the manufacturing overhead cost per wheel of each model using ABC.

3. Compute the company's traditional plantwide overhead rate. Use this rate to determine th manufacturing overhead cost per wheel under the traditional system.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:30, jluckie080117

In business, what would be the input, conversion and output of operating a summer band camp

Answers: 1

Business, 22.06.2019 15:20, iselloutt4fun

Kelso electric is debating between a leveraged and an unleveraged capital structure. the all equity capital structure would consist of 40,000 shares of stock. the debt and equity option would consist of 25,000 shares of stock plus $280,000 of debt with an interest rate of 7 percent. what is the break-even level of earnings before interest and taxes between these two options?

Answers: 2

Business, 22.06.2019 19:30, cyynntthhiiaa4

Fly-by products, inc. operates primarily in the united states and has several segments. for the following segment, determine whether it is a cost center, profit center, or investment center: international operations- acts as an independent segment responsible for all facets of the business outside of the united states. select one: a. cost center b. profit center c. investment center

Answers: 2

Business, 22.06.2019 22:00, levicorey846

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

Do you know the correct answer?

Questions in other subjects:

English, 23.10.2020 22:10

Mathematics, 23.10.2020 22:10

History, 23.10.2020 22:10

English, 23.10.2020 22:10

Physics, 23.10.2020 22:10

English, 23.10.2020 22:10

Biology, 23.10.2020 22:10

English, 23.10.2020 22:10