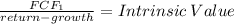

JenBritt Incorporated had a free cash flow (FCF) of $80 million in 2019. The firm projects FCF of $200 million in 2020 and $500 million in 2021. FCF is expected to grow at a constant rate of 4% in 2022 and thereafter. The weighted average cost of capital is 9%. What is the current (i. e., beginning of 2020) value of operations

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:00, paolaf9996

Intronix uses copy editors, computer graphics specialists, and java programmers to produce ads for magazines and the internet. the average new ad for magazines typically requires 180 hours of a copy editor's time and 135 hours of a computer graphics specialist's time, whereas ads produced for the internet require 35 hours of copy editor time, 195 hours of computer graphics time, and 60 hours of a java programmer's time. lassie food, a dog food manufacturer, has hired intronix to produce ads in the next four week. although currently it considers magazine ads 3 times more valuable than internet ads, it still wishes to have at least 2 of each produced within the next four weeks. intronix has assigned up to 3 copy editors, 4 computer graphics specialists, and 1 java programmer, each committed to work up to 70 hours per week on the project. how many of each type of ad should be produced to maximize the overall value to lassie foods

Answers: 3

Business, 22.06.2019 11:30, wrivera32802

Leon and sara are arguing over when the best time is to degrease soup. leon says that it's easiest to degrease soup when it's boiling. sara says it's easiest to degrease soup when it's cold. who is correct? a. neither leon nor sara is correct. b. leon is correct. c. both leon and sara are correct. d. sara is correct. student b incorrect which following answer correct?

Answers: 1

Business, 22.06.2019 17:00, ruchierosanp1n3qw

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. the portfolio's beta is 1.12. you plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.50. what will the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 23.06.2019 15:00, ayyyyy65

Ronaldo attends an important meeting with his supervisor and a customer. he thought the meeting went well, but ronaldo's supervisor tells him that he displayed negative nonverbal communication towards the customer. ronaldo replays the meeting in his mind. which of ronaldo's actions is his supervisor referring to?

Answers: 2

Do you know the correct answer?

JenBritt Incorporated had a free cash flow (FCF) of $80 million in 2019. The firm projects FCF of $2...

Questions in other subjects:

Business, 22.05.2020 05:59

English, 22.05.2020 05:59