Business, 18.02.2020 06:13, imlexi12393

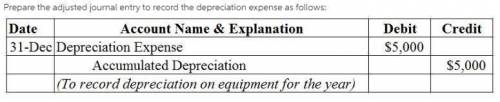

At the end of its first year, the trial balance of Denton Company shows Equipment $30,000 and zero balances in Accumulated Depreciation-Equipment and Depreciation Expense. Depreciation for the year is estimated to be $5,000. Prepare the adjusting entry for depreciation at December 31.

Date Account/Description Debit Credit

Dec. 31

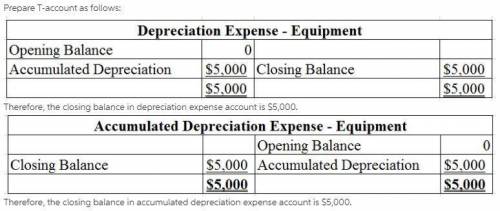

Using T accounts, enter the balances in the accounts below, post the adjusting entry as necessary, and indicate the adjusted balance in each account. (If there is no transaction, enter 0 for the amount.)

Depreciation Expense - Equipment

12/31 12/31

Accumulated Depreciation - Equipment

12/31 12/31

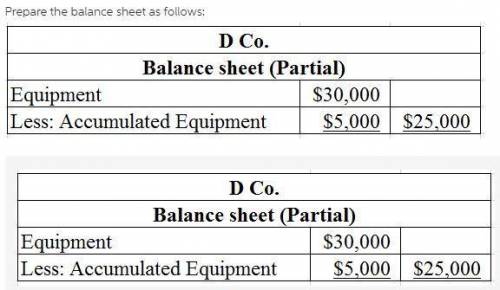

Indicate the balance sheet presentation of the equipment at December 31.

Balance Sheet:

Equipment $

Less: Accumulated Depreciation

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:50, vcornejo7

Seattle bank’s start-up division establishes new branch banks. each branch opens with three tellers. total teller cost per branch is $96,000 per year. the three tellers combined can process up to 90,000 customer transactions per year. if a branch does not attain a volume of at least 60,000 transactions during its first year of operations, it is closed. if the demand for services exceeds 90,000 transactions, an additional teller is hired and the branch is transferred from the start-up division to regular operations. required what is the relevant range of activity for new branch banks

Answers: 2

Business, 22.06.2019 12:50, 20170020

Kyle and alyssa paid $1,000 and $4,000 in qualifying expenses for their two daughters jane and jill, respectively, to attend the university of california. jane is a sophomore and jill is a freshman. kyle and alyssa's agi is $135,000 and they file a joint return. what is their allowable american opportunity tax credit after the credit phase-out based on agi is taken into account?

Answers: 1

Do you know the correct answer?

At the end of its first year, the trial balance of Denton Company shows Equipment $30,000 and zero b...

Questions in other subjects:

Mathematics, 29.09.2019 16:00

Mathematics, 29.09.2019 16:00

Social Studies, 29.09.2019 16:00

Physics, 29.09.2019 16:00

English, 29.09.2019 16:00

Social Studies, 29.09.2019 16:00