Business, 18.02.2020 06:05, RafMad5018

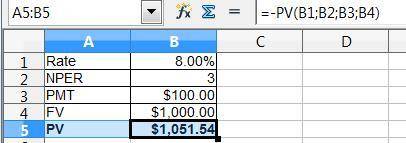

A 3-year bond with 10% coupon rate and $1000 face value yields 8%. Assuming annual coupon payment, calculate the price of the bond.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 14:30, allyssaharrisooy50au

Consider a two-firm industry. firm 1 (the incumbent) chooses a level of output q1. firm 2 (the potential entrant) observes q1 and then chooses its level of output q2. the demand for the product is p = 100 - q, where q is the total output sold by the two firms which equals q1 +q2. assume that the marginal cost of each firm is zero. a) find the subgame perfect equilibrium levels of q1 and q2 keeping in mind that firm 1 chooses q1 first and firm 2 observes q1 and chooses its q2. find the profits of the two firms-? 1 and ? 2- in the subgame perfect equilibrium. how do these numbers differ from the cournot equilibrium? b) for what level of q1 would firm 2 be deterred from entering? would a rational firm 1 have an incentive to choose this level of q1? which entry condition does this market have: blockaded, deterred, or accommodated? now suppose that firm 2 has to incur a fixed cost of entry, f > 0. c) for what values of f will entry be blockaded? d) find out the entry deterring level of q1, denoted by q1b, as a function of f. next, derive the expression for firm 1

Answers: 1

Business, 22.06.2019 07:30, kennaklein2

When selecting a savings account, you should look at the following factors except annual percentage yield (apy) fees minimum balance interest thresholds taxes paid on the interest variable interest rates

Answers: 1

Business, 22.06.2019 16:30, cadenbukvich9923

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Do you know the correct answer?

A 3-year bond with 10% coupon rate and $1000 face value yields 8%. Assuming annual coupon payment, c...

Questions in other subjects:

History, 27.05.2021 03:40

Biology, 27.05.2021 03:40

Arts, 27.05.2021 03:40

History, 27.05.2021 03:40