Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:40, ipcmeaganlatham

wilson's has 10,000 shares of common stock outstanding at a market price of $35 a share. the firm also has a bond issue outstanding with a total face value of $250,000 which is selling for 102 percent of face value. the cost of equity is 11 percent while the preminustax cost of debt is 8 percent. the firm has a beta of 1.1 and a tax rate of 34 percent. what is wilson's weighted average cost of capital?

Answers: 3

Business, 22.06.2019 04:00, neariah24

Assume that the following conditions exist: a. all banks are fully loaned up- there are no excess reserves, and desired excess reserves are always zero. b. the money multiplier is 5 . c. the planned investment schedule is such that at a 4 percent rate of interest, investment =$1450 billion. at 5 percent, investment is $1420 billion. d. the investment multiplier is 3 . e.. the initial equilibrium level of real gdp is $12 trillion. f. the equilibrium rate of interest is 4 percent now the fed engages in contractionary monetary policy. it sells $1 billion worth of bonds, which reduces the money supply, which in turn raises the market rate of interest by 1 percentage point. calculate the decrease in money supply after fed's sale of bonds: $nothing billion.

Answers: 2

Business, 22.06.2019 11:10, AM28

Your team has identified the risks on the project and determined their risk score. the team is in the midst of determining what strategies to put in place should the risks occur. after some discussion, the team members have determined that the risk of losing their network administrator is a risk they'll just deal with if and when it occurs. although they think it's a possibility and the impact would be significant, they've decided to simply deal with it after the fact. which of the following is true regarding this question? a. this is a positive response strategy. b. this is a negative response strategy. c. this is a response strategy for either positive or negative risk known as contingency planning. d. this is a response strategy for either positive or negative risks known as passive acceptance.

Answers: 2

Do you know the correct answer?

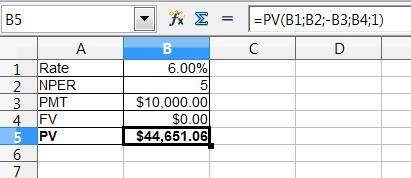

Harry Rawlings wants to withdraw $10,000 (including principal) from an investment fund at the end of...

Questions in other subjects:

Physics, 19.12.2021 14:00

Physics, 19.12.2021 14:00

Social Studies, 19.12.2021 14:00

Mathematics, 19.12.2021 14:00