Business, 15.02.2020 02:55, amandaparrish2323

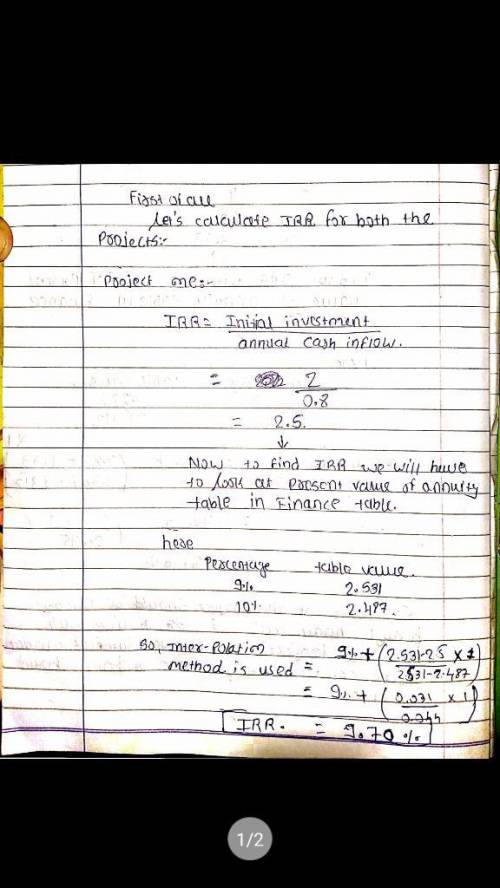

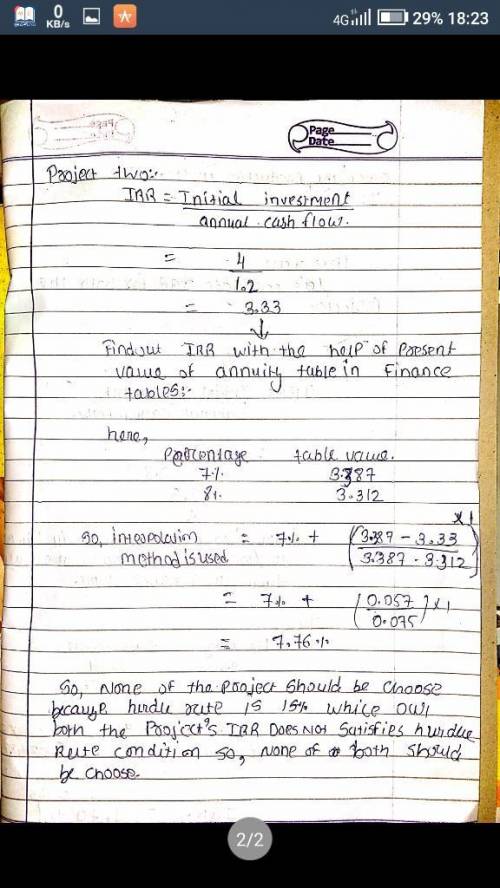

An energy-conservation study has produced a base case that is a heat-recovery project. The TCI is $5.0 MM and the project provides an annual net profit of $1.0 MM year. Two add-on alternatives are proposed as possible modifications to the base case:

(i) The addition of an additional heat exchanger, which will cost an additional $2.0 MM of TCI and will result in a total annual net profit of $1.8 MM/year for the combined base case and the additional heat exchanger.

(ii) The addition of a steam turbine for cogeneration of heat and power. The turbine coupled with the heat-recovery network and the additional heat exchanger. The turbine will cost $4.0 MM in addition to the TCI of the base-case heat-recovery network and the additional heat exchanger. It will result in a total annual net profit of $2.2 MM/year for the combined base case, additional exchanger, and turbine.

The company has a 15% per year minimum hurdle rate. Which projects should you recommend?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:30, KylaChanel4756

You are frustrated to find that the only way to contact the customer service department is to make a phone call. the number listed would result in long distance charges to your phone bill. which issue should be addressed by the company to keep its crm in line with your expectations?

Answers: 2

Business, 22.06.2019 12:20, KindaSmartPersonn

Bdj co. wants to issue new 22-year bonds for some much-needed expansion projects. the company currently has 9.2 percent coupon bonds on the market that sell for $1,132, make semiannual payments, have a $1,000 par value, and mature in 22 years. what coupon rate should the company set on its new bonds if it wants them to sell at par?

Answers: 3

Business, 22.06.2019 17:50, ratpizza

Abc factory produces 24,000 units. the cost sheet gives the following information: direct materials rs. 1,20,000direct labour rs. 84,000variable overheads rs. 48,000semi variable overheads rs. 28,000fixed overheads rs. 80,000total cost rs. 3,60,000presently the product is sold at rs. 20 per unit. the management proposes to increase the production by 3,000 units for sales in the foreign market . it is estimated that semi variable overheads will increase by rs. 1,000. but the product will be sold at rs. 14 per unit in the foreign market. however, no additional capital expenditure will be incurredq-1. what is present profit of the company ? q-2. what is proposed profit of the company in new market? q-3.what is suggestion for new makret proposal whether proposal accept or not

Answers: 1

Business, 22.06.2019 20:20, jennybee12331

Precision aviation had a profit margin of 6.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. what was the firm's roe? a. 15.23%b. 16.03%c. 16.88%d. 17.72%e. 18.60%

Answers: 2

Do you know the correct answer?

An energy-conservation study has produced a base case that is a heat-recovery project. The TCI is $5...

Questions in other subjects:

English, 28.05.2020 02:03

Business, 28.05.2020 02:03

Mathematics, 28.05.2020 02:03

Chemistry, 28.05.2020 02:03

Mathematics, 28.05.2020 02:03

Mathematics, 28.05.2020 02:03