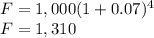

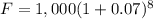

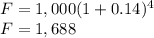

Calculate the future value of $1,000 in a. Four years at an interest rate of 7% per year. b. Eight years at an interest rate of 7% per year. c. Four years at an interest rate of 14% per year. d. Why is the amount of interest earned in part (a) less than half the amount of interest earned in part (b)? b. Eight years at an interest rate of 7% per year. The future value of $1,000 in 8 years at an interest rate of 7% per year is (Round to the nearest dollar.) c. Four years at an interest rate of 14% per year. The future value of $1,000 in 4 years at an interest rate of 14% per year is (Round to the nearest dollar.) d. Why is the amount of interest earned in part (a) less than half the amount of interest earned in part (b)? (Select the best choice below.) A. This results because you earn interest on past interest. Since more interest has been paid at the end of the time period than at the beginning, the money grows faster. B. The interest earned in part (a) is based on a lower effective annual interest rate. C. The annual interest rate in part (b) is slightly higher than the rate assumed in part (a). This is because of compounding D. The amount of interest earned in part (a) is really half of the amount of interest earned in part (b) since in part (b) the money grows for twice as many years as in part (a).

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:00, singfreshjazz3370

Colah company purchased $1.8 million of jackson, inc. 8% bonds at par on july 1, 2018, with interest paid semi-annually. when the bonds were acquired colah decided to elect the fair value option for accounting for its investment. at december 31, 2018, the jackson bonds had a fair value of $2.08 million. colah sold the jackson bonds on july 1, 2019 for $1,620,000. the purchase of the jackson bonds on july 1. interest revenue for the last half of 2018. any year-end 2018 adjusting entries. interest revenue for the first half of 2019. any entry or entries necessary upon sale of the jackson bonds on july 1, 2019. required: 1. prepare colah's journal entries for above transaction.

Answers: 1

Business, 22.06.2019 04:30, mt137896

Required prepare the necessary adjusting entries in the general journal as of december 31, assuming the following: on september 1, the company entered into a prepaid equipment maintenance contract. birch company paid $3,400 to cover maintenance service for six months, beginning september 1. the payment was debited to prepaid maintenance. supplies on hand at december 31 are $3,900. unearned commission fees at december 31 are $7,000. commission fees earned but not yet billed at december 31 are $3,500. (note: debit fees receivable.) birch company's lease calls for rent of $1,600 per month payable on the first of each month, plus an annual amount equal to 1% of annual commissions earned. this additional rent is payable on january 10 of the following year. (note: be sure to use the adjusted amount of commissions earned in computing the additional rent.)

Answers: 1

Business, 22.06.2019 17:50, Senica

Bandar industries berhad of malaysia manufactures sporting equipment. one of the company’s products, a football helmet for the north american market, requires a special plastic. during the quarter ending june 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. the plastic cost the company $171,000. according to the standard cost card, each helmet should require 0.6 kilograms of plastic, at a cost of $8 per kilogram. 1. what is the standard quantity of kilograms of plastic (sq) that is allowed to make 35,000 helmets? 2. what is the standard materials cost allowed (sq x sp) to make 35,000 helmets? 3. what is the materials spending variance? 4. what is the materials price variance and the materials quantity variance?

Answers: 1

Business, 22.06.2019 18:00, kekoanabor19

Abbington company has a manufacturing facility in brooklyn that manufactures robotic equipment for the auto industry. for year 1, abbingtonabbington collected the following information from its main production line: actual quantity purchased-200 units, actual quantity used-110 units, units standard quantity-100 units, actual price paid-$8 per unit, standard price-$10 per unit. atlantic isolates price variances at the time of purchase. what is the materials price variance for year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable.

Answers: 2

Do you know the correct answer?

Calculate the future value of $1,000 in a. Four years at an interest rate of 7% per year. b. Eight y...

Questions in other subjects:

Business, 18.01.2021 14:00

Mathematics, 18.01.2021 14:00

English, 18.01.2021 14:00