Business, 14.02.2020 02:03, jessezarate4513

Problem 18-02A a-b, d (Part Level Submission) Crane Diesel owns the Fredonia Barber Shop. He employs 6 barbers and pays each a base rate of $1,490 per month. One of the barbers serves as the manager and receives an extra $600 per month. In addition to the base rate, each barber also receives a commission of $10.40 per haircut. Other costs are as follows. Advertising $220 per month Rent $950 per month Barber supplies $0.50 per haircut Utilities $195 per month plus $0.10 per haircut Magazines $30 per month Crane currently charges $20 per haircut.

Instructions

(a)

Determine the variable costs per haircut and the total monthly fixed costs.

(a) VC $5

(b)

Compute the break-even point in units and dollars.

(c)

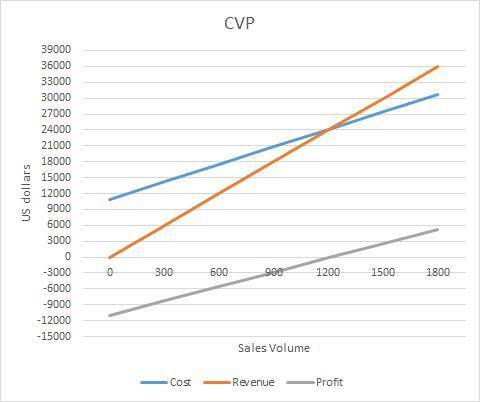

Prepare a CVP graph, assuming a maximum of 1,800 haircuts in a month. Use increments of 300 haircuts on the horizontal axis and $3,000 on the vertical axis.

(d)

Determine net income, assuming 1,600 haircuts are given in a month.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:30, orteg555a

Clonex labs, inc., uses the weighted-average method in its process costing system. the following data are available for one department for october: percent completed units materials conversion work in process, october 1 53,000 90 % 65 % work in process, october 31 29,000 74 % 52 % the department started 381,000 units into production during the month and transferred 405,000 completed units to the next department. required: compute the equivalent units of production for october.

Answers: 2

Business, 22.06.2019 13:00, eggoysters

Dakota products has a production budget as follows: may, 16,000 units; june, 19,000 units; and july, 24,000 units. each unit requires 3 pounds of raw material and 2 direct labor hours. dakota desires to keep an inventory of 10% of the next month’s requirements on hand. on may, 1 there were 4,800 pounds of raw material in inventory. direct labor hours required in may would be:

Answers: 1

Business, 22.06.2019 13:40, ilovecatsomuchlolol

A. j. was a newly hired attorney for idle time gaming, inc. even though he reported directly to the president of the company, a. j. noticed that the president always had time to converse with the director of sales, calling on him to get a pulse on legal/regulatory issues that, as the company attorney, a. j. could have probably handled. a. j. also noted that the hr manager’s administrative assistant was the go-to person for a number of things that would make life easier at work. a. j. was recognizing the culture at idle time gaming.

Answers: 3

Business, 22.06.2019 14:30, Hannahdavy5434

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

Do you know the correct answer?

Problem 18-02A a-b, d (Part Level Submission) Crane Diesel owns the Fredonia Barber Shop. He employs...

Questions in other subjects:

Mathematics, 04.07.2019 00:10

Computers and Technology, 04.07.2019 00:10

Biology, 04.07.2019 00:10

Chemistry, 04.07.2019 00:10

Computers and Technology, 04.07.2019 00:10

Computers and Technology, 04.07.2019 00:20