Business, 11.02.2020 21:48, lerasteidl

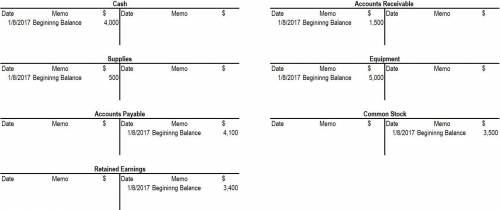

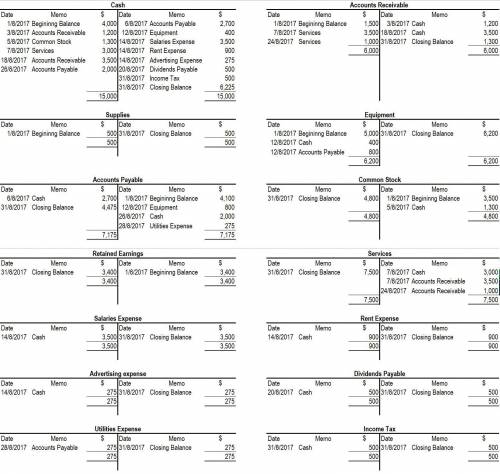

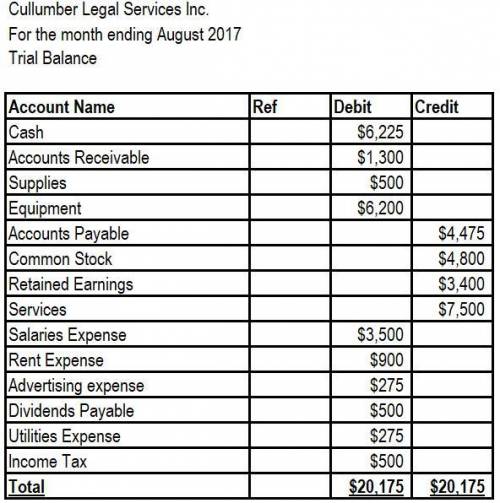

On July 31 2017, the general ledger of Cullumber Legal Services Inc., showed the following balances:cash $4000Accounts Receivable $1500Supplies $500Equipment $5000Accounts Payable: $4,100Common Stock $3500Retained Earnings $3400During August, the following transactions occurred:August 3rd: Collected $1200 of accounts receivable due from customersAugust 5: recieved $1300 cash from issuing common stock to new investorsAugust 6: paid $2700 on accounts payableAugust 7: performed legal services of $6500, of which $3000 was collected in cash and the remainder was due on account. August 12: Purchased additional equipment for $1200, paying $400 on cash and the balance on accountAugust 14: Paid salaries $3500, rent $900, and advertising expenses $275 for month of AugustAugust 18: collected blanace for the services performed on August 7August 20: Paid dividends of $500 to stockholdersAugust 24: Billed a client $1,000 for services performedAugust 26: received $2000 from Laurentian Bank, the money was borrowed on a bank note payable that is due in 6 monthsAugust 27: Agreed to perform legal services for a client in September for $4500. The client will pay the amount owing after the services have been performedAugust 28: received the utility bill for the month of august in the amount of $275; it is not due until September 15.August 31: paid income tax for the month of $500.Part 1: Using T-accounts enter the beginning balances to the ledger. Part 2: Journalize the August transactionsPart 3: Post the August journal entries to he ledgerPart 4: Prepare a trial balance on August 31 2017.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 17:20, keshonerice

Luis and rosa, citizens of costa rica, moved to the united states in year 1 where they both lived and worked. in year 3, they provided the total support for their four young children (all under the age of 10). two children lived with luis and rosa in the u. s., one child lived with his aunt in mexico, and one child lived with her grandmother in costa rica. none of the children earned any income. all of the children were citizens of costa rica. the child in mexico was a resident of mexico, and the child in costa rica was a resident of costa rica. how many total exemptions (personal exemptions plus exemptions for dependents) may luis and rosa claim on their year 3 joint income tax return? a. 6 b. 5 c. 4 d. 2

Answers: 3

Business, 22.06.2019 12:30, deedee363

In the 1970s, kmart used blue light specials to encourage customers to flock to a particular department having a temporary sale. a spinning blue light activated for approximately 30 seconds, and then an in-store announcement informed shoppers of the special savings in the specific department. over time, loyal kmart shoppers learned to flock to the department with the spinning blue light before any announcement of special savings occurred. if kmart was employing classical conditioning techniques, what role did the spinning blue light play?

Answers: 3

Business, 22.06.2019 13:30, bobbycisar1205

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

Business, 22.06.2019 14:30, karleygirl2870

Your own record of all your transactions. a. check register b. account statement

Answers: 1

Do you know the correct answer?

On July 31 2017, the general ledger of Cullumber Legal Services Inc., showed the following balances:...

Questions in other subjects: