Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, lalacada1

If delta airlines were to significantly change its fare structure and flight schedule to enhance its competitive position in response to aggressive price cutting by southwest airlines, this would be an example ofanswers: explicit collusion. tacit collusion. competitive dynamics. a harvest strategy.

Answers: 3

Business, 22.06.2019 15:40, brookekolmetz

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

Do you know the correct answer?

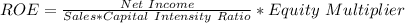

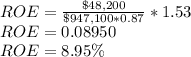

Bamp co. has net income of $48,200, sales of $947,100, a capital intensity ratio of .87, and an equi...

Questions in other subjects:

Arts, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

History, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00