Business, 25.01.2020 01:31, cylertroutner

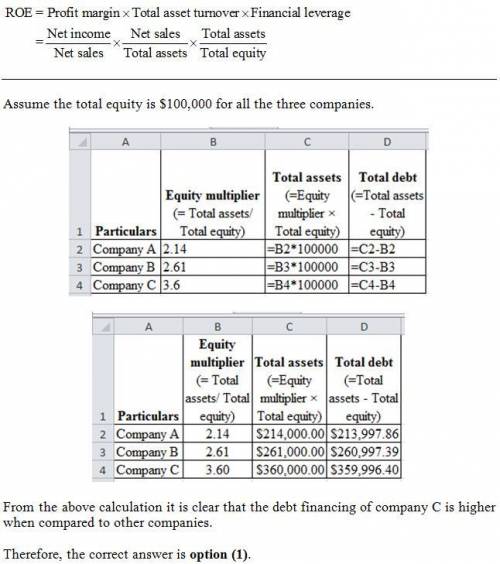

Corporate decision makers and analysts often use a particular technique, called a dupont analysis, to better understand the factors that drive a company's financial performance, as reflected by its return on equity (roe). by using the dupont equation, which disaggregates the roe into three components, analysts can see why a company's roe may have changed for the better or worse, and identify particular company strengths and weaknesses the dupont equation a dupont analysis is conducted using the dupont equation, which to identify and analyze three important factors that drive a company's roe. according to the equation, which of the following factors directly affect a company's roe? check all that apply price per share earnings per share sales / total assets net income/ sales most investors and analysts in the financial community pay particular attention to a company's roe. the roe can be calculated simply by dividing a firm's net income by the firm's shareholder's equity, and it can be subdivided into the key factors that drive the roe. investors and analysts focus on these drivers to develop a clearer picture of what is happening within a company. an analyst gathered the following data and calculated the various terms of the dupont equation for three companies: roe 12.0% 15.5% 21.5% profit margin x total assets turnover x equity multiplier company a company b company c 57.3% 58.2% 58.0% 9.8 10.2 10.3 2.14 2.61 3.60 referring to these data, which of the following conclusions will be true about the companies' roes? o the main driver of company a's inferior roe, as compared to that of company b's and company c's roe, is its use of higher debt financing o the main driver of company a's inferior roe, as compared to that of company c's roe, is its higher total asset turnover ratio the main driver of company c's superior roe, as compared to that of company a's and company b's roe, is its greater use of debt financing

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 17:30, tysisson9612

You should do all of the following before a job interview except

Answers: 2

Business, 22.06.2019 20:00, pickelswolf3036

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

Business, 22.06.2019 22:20, Shubbs

Which of the following is one disadvantage of renting a place to live compared to buying a home? a. tenants have to pay for all repairs to the building. b. the landlord covers the expenses of maintaining the property. c. residents can't alter their living space without permission. d. rent is generally more than monthly mortgage payments.

Answers: 1

Business, 23.06.2019 02:20, chaanah

The director of the federal trade commission (ftc) bureau of consumer protection warned that the agency would bring enforcement action against small businesses that select one: a. failed to inform the public about network failures in a timely manner b. failed to transmit sensitive data c. did not report security breaches to law enforcement d. lacked adequate policies and procedures to protect consumer data.

Answers: 2

Do you know the correct answer?

Corporate decision makers and analysts often use a particular technique, called a dupont analysis, t...

Questions in other subjects:

Mathematics, 02.03.2021 01:20

French, 02.03.2021 01:20

History, 02.03.2021 01:20

English, 02.03.2021 01:20

Physics, 02.03.2021 01:20