Business, 22.01.2020 04:31, annaebrown4406

The dividend growth model: a. can be used to value both dividend-paying and non-dividend-paying stocks. b. cannot be used to value constant dividend stocks. c. requires the growth rate to be less than the required return. d. only values stocks at time 0. assumes dividends increase at a decreasing rate.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:50, clwalling04

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning

Answers: 2

Business, 21.06.2019 21:00, cooltez100

Sheldon has the following year-end account balances: accounts receivable, $5,000; supplies, $12,000; equipment, $18,000; accounts payable, $17,000; stockholders’ equity, $43,000. the cash account balance was not available at year-end. given the account balances listed, the balance in the cash account should be?

Answers: 2

Business, 22.06.2019 05:30, adazeb2003

Find a company that has followed a strong strategic direction- state that generic strategy and the back-up points to support your position.

Answers: 1

Do you know the correct answer?

The dividend growth model: a. can be used to value both dividend-paying and non-dividend-paying sto...

Questions in other subjects:

Mathematics, 01.01.2022 21:20

Mathematics, 01.01.2022 21:20

Biology, 01.01.2022 21:30

)

)

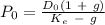

= Last paid dividend per share

= Last paid dividend per share = Cost Of Equity or Investor's required rate of return

= Cost Of Equity or Investor's required rate of return