Case study: capitalization versus expensing

gloria hernandez is the controller of a pu...

Case study: capitalization versus expensing

gloria hernandez is the controller of a public company. she just completed a meeting with her superior, john harrison, who is the cfo of the company. harrison tried to convince hernandez to go along with his proposal to combine 12 expenditures for repair and maintenance of a plant asset into one amount ($1 million). each of the expenditures is less than $100,000, the cutoff point for capitalizing expenditures as an asset and depreciating it over the useful life. hernandez asked for time to think about the matter. as the controller and chief accounting officer of the company, hernandez knows it’s her responsibility to decide how to record the expenditures. she knows that the $1 million amount is material to earnings and the rules in accounting require expensing of each individual item, not capitalization. however, she is under a great deal of pressure to go along with capitalization to boost earnings and meet financial analysts’ earnings expectations and provide for a bonus to top management including herself. her job may be at stake, and she doesn’t want to disappoint her boss.

questions assume both hernandez and harrison hold the cpa and cma designations.

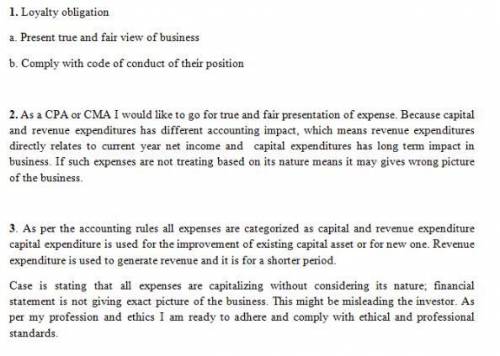

1. what are the loyalty obligations of both parties in this case?

2. assume that you were in gloria hernandez’s position. what would motivate you to speak up and act or to stay silent? would it make a difference if harrison promised this was a one-time request?

3. what would you do and why?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:20, johnlecona210

Security a has a higher standard deviation of returns than security b. we would expect that: (i) security a would have a risk premium equal to security b. (ii) the likely range of returns for security a in any given year would be higher than the likely range of returns for security b. (iii) the sharpe ratio of a will be higher than the sharpe ratio of b. (a) i only (b) i and ii only (c) ii and iii only (d) i, ii and iii

Answers: 1

Business, 22.06.2019 12:30, cheyannehatton

Suppose that two firms produce differentiated products and compete in prices. as in class, the two firms are located at two ends of a line one mile apart. consumers are evenly distributed along the line. the firms have identical marginal cost, $60. firm b produces a product with value $110 to consumers. firm a (located at 0 on the unit line) produces a higher quality product with value $120 to consumers. the cost of travel are directly related to the distance a consumer travels to purchase a good. if a consumerhas to travel a mile to purchase a good, the incur a cost of $20. if they have to travel x fraction of a mile, they incur a cost of $20x. (a) write down the expressions for how much a consumer at location d would value the products sold by firms a and b, if they set prices p_{a} and p_{b} ? (b) based on your expressions in (a), how much will be demanded from each firm if prices p_{a} and p_{b} are set? (c) what are the nash equilibrium prices?

Answers: 3

Business, 22.06.2019 15:30, barstr9146

Brenda wants a new car that will be dependable transportation and look good. she wants to satisfy both functional and psychological needs. true or false

Answers: 1

Do you know the correct answer?

Questions in other subjects:

Mathematics, 12.03.2020 00:42

Mathematics, 12.03.2020 00:42

Mathematics, 12.03.2020 00:42