Business, 17.01.2020 19:31, jrsecession

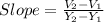

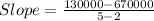

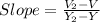

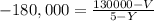

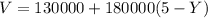

For tax and accounting purposes, corporations depreciate the value of equipment each year. one method used is called "linear depreciation," where the value decreases over time in a linear manner. suppose that two years after purchase, an industrial milling machine is worth $670,000, and five years after purchase, the machine is worth $130,000. find a formula for the machine value v (in thousands of dollars) at time t ≥ 0 after purchase.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:00, lm942747

What is the difference between an "i" statement and a "you" statement? a. the "i" statement is non-confrontational b. the "you" statement is non-confrontational c. the "i" statement is argumentative d. the "you" statement is neutral in tone select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 11:00, mateoperkins

What is the advantage of developing criteria for assessing the effectiveness of business products and processes? a. assessment criteria are answers. b. assessment criteria are inexpensive. c. assessment criteria provide you with a list of relevant things to measure. d. assessment criteria provide you with a list of people to contact to learn more about process mentoring.

Answers: 3

Business, 22.06.2019 11:40, sabrinabowers4308

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

Business, 22.06.2019 22:30, chad65

Which of the following situations is most likely to change a buyer's market into a seller's market? a. a natural disaster that drives away a lot of the population. b. the price of building materials suddenly going up. c. the government buys up a lot of houses to build a new freeway. d. a factory laying off a lot of workers in the area.

Answers: 1

Do you know the correct answer?

For tax and accounting purposes, corporations depreciate the value of equipment each year. one metho...

Questions in other subjects:

Mathematics, 08.04.2020 19:15

Chemistry, 08.04.2020 19:15

Physics, 08.04.2020 19:15

Mathematics, 08.04.2020 19:15