Business, 16.01.2020 00:31, milkshakegrande101

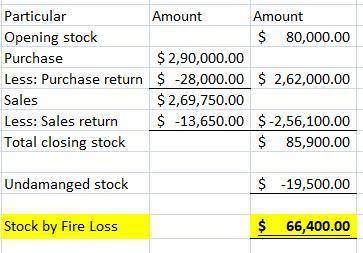

Eastman company lost most of its inventory in a fire in december just before the year-end physical inventory was taken. corporate records disclose the following. inventory (beginning) $ 80,000 sales revenue $415,000 purchases 290,000 sales returns 21,000 purchase returns 28,000 gross profit % based on net selling price 35 % merchandise with a selling price of $30,000 remained undamaged after the fire, and damaged merchandise has a net realizable value of $8,150. the company does not carry fire insurance on its inventory. compute the amount of inventory fire loss. (do not use the retail inventory method.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 16:50, Softball6286

Carver company produces a product which sells for $30. variable manufacturing costs are $15 per unit. fixed manufacturing costs are $5 per unit based on the current level of activity, and fixed selling and administrative costs are $4 per unit. a selling commission of 10% of the selling price is paid on each unit sold. the contribution margin per unit is:

Answers: 2

Business, 22.06.2019 12:10, ghari112345

In year 1, the bennetts' 25-year-old daughter, jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. in previous years, jane has never worked and her parents have always been able to claim her as a dependent. in year 1, a kind neighbor offers to pay for all of jane's educational and living expenses. which of the following statements is most accurate regarding whether jane's parents would be allowed to claim an exemption for jane in year 1 assuming the neighbor pays for all of jane's support? a. no, jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative. b.yes, because she is a full-time student and does not provide more than half of her own support, jane is considered her parent's qualifying child. c.no, jane is too old to be considered a qualifying child and fails the support test of a qualifying relative. d.yes, because she is a student, her absence is considered as "temporary." consequently she meets the residence test and is a considered a qualifying child of the bennetts.

Answers: 2

Business, 22.06.2019 19:00, FoxGirl1971

1. regarding general guidelines for the preparation of successful soups, which of the following statements is true? a. thick soups made with starchy vegetables may thin during storage. b. soups should be seasoned throughout the cooking process. c. finish a cream soup well before serving it to moderate the flavor. d. consommés take quite a long time to cool.

Answers: 2

Do you know the correct answer?

Eastman company lost most of its inventory in a fire in december just before the year-end physical i...

Questions in other subjects:

Biology, 30.04.2021 21:10

Mathematics, 30.04.2021 21:10

Social Studies, 30.04.2021 21:10

History, 30.04.2021 21:10

English, 30.04.2021 21:10

Health, 30.04.2021 21:10

Mathematics, 30.04.2021 21:10