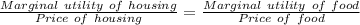

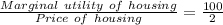

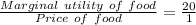

Bob consumes food and housing. suppose his marginal utility from an additional unit of food is 20 and his marginal utility from an additional unit of housing is 100. furthermore, suppose the price of a unit of food is $1.00 and the price of a unit of housing is $2.00. can bob increase his utility without changing his total expenditures on food and housing? holding expenditures constant,

a. bob can increase utility by spending more on food and the same amount on housing.

b. bob cannot increase his utility

c. bob can increase utility by spending more on food and less on housing.

d. bob can increase utility by spending more on food and more on housing.

e. bob can increase utility by spending less on food and more on housing.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, jordaaan101

Agood for which demand increases as income rises is and a good for which demand increases as income falls is

Answers: 1

Business, 22.06.2019 03:00, zelds63481

Which of the following is an effective strategy when interest rates are falling? a. use long-term loans to take advantage of current low rates. b. use short-term loans to take advantage of lower rates when you refinance a loan. c. deposit to a short-term savings instrumentals to take advantage of higher interest rates when they mature. d. select short-term savings instruments to lock in earnings at a current high rates.

Answers: 1

Business, 22.06.2019 08:10, alex7881

The last time he flew jet value air, juan's plane developed a fuel leak and had to make an 4) emergency landing. the time before that, his plane was grounded because of an electrical problem. juan is sure his current trip will be fraught with problems and he will once again be delayed. this is an example of the bias a) confirmation b) availability c) selective perception d) randomness

Answers: 1

Business, 22.06.2019 12:30, cuppykittyy

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Do you know the correct answer?

Bob consumes food and housing. suppose his marginal utility from an additional unit of food is 20 an...

Questions in other subjects:

History, 08.04.2020 20:22

Biology, 08.04.2020 20:22

English, 08.04.2020 20:22

Mathematics, 08.04.2020 20:22

Mathematics, 08.04.2020 20:22