Business, 14.01.2020 02:31, gisellekarime

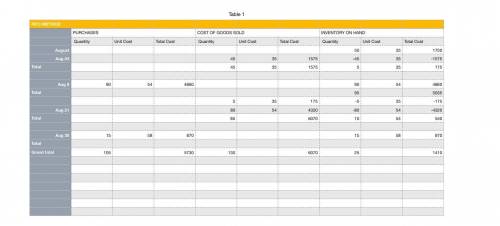

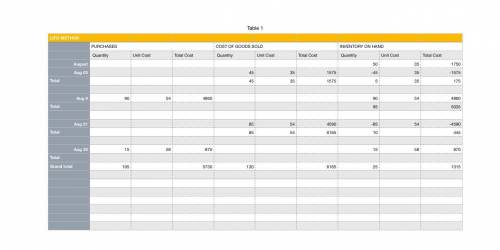

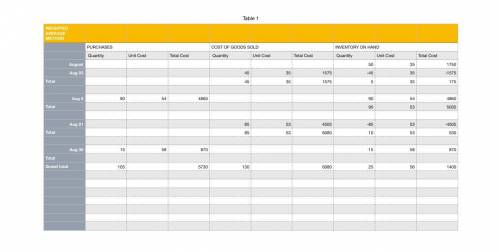

Assume the perpetual inventory system is used unless stated otherwise. accounting for inventory using the perpetual inventory system—fifo, lifo, and weighted-average, and comparing fifo, lifo, and weighted-average steel mill began august with 50 units of iron inventory that cost s35 each. during august, the company completed the following inventory transactions:

units unit cost unit sale price

aug. 3 sale 45 $85

8 purchase 90 $54

21 sale 85 88

30 purchase 15 58

requirements

1. prepare a perpetual inventory record for the merchandise inventory using the fifo inventory costing method.

2. prepare a perpetual inventory record for the merchandise inventory using the lifo inventory costing method.

3. prepare a perpetual inventory record for the merchandise inventory using the weighted-average inventory costing method.

4. determine the company's cost of goods sold for august using fifo, lifo, and weighted-average inventory costing methods.

5. compute gross profit for august using fifo, lifo, and weighted-average inventory costing methods.

6. if the business wanted to maximize gross profit, which method would it select?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:00, krutikov686

Which is not an example of a cyclical company? a) airlines b) hotel industry c) medical d) theme parks

Answers: 1

Business, 22.06.2019 11:00, mmcdaniels46867

Companies hd and ld are both profitable, and they have the same total assets (ta), total invested capital, sales (s), return on assets (roa), and profit margin (pm). both firms finance using only debt and common equity. however, company hd has the higher total debt to total capital ratio. which of the following statements is correct? a) company hd has a higher assets turnover than company ld. b) company hd has a higher return on equity than company ld. c) none of the other statements are correct because the information provided on the question is not enough. d) company hd has lower total assets turnover than company ld. e) company hd has a lower operating income (ebit) than company ld

Answers: 2

Business, 22.06.2019 11:10, macylen3900

Verizon communications, inc., provides the following footnote relating to its leasing activities in its 10-k report. the aggregate minimum rental commitments under noncancelable leases for the periods shown at december 31, 2010, are as follows: years (dollars in millions) capital leases operatingleases 2011 $97 $1,898 2012 74 1,720 2013 70 1,471 2014 54 1,255 2015 42 1,012 thereafter 81 5,277 total minimum 418 $ 12,633 rental commitments less interest and (86) executory costs present value of 332 minimum lease payments less current (75) installments long-term obligation $257 at december 31, 2010 (a) confirm that verizon capitalized its capital leases using a rate of 7.4 %. (b) compute the present value of verizon's operating leases, assuming an 7.4% discount rate and rounding the remaining lease term to 3 decimal places. (use a financial calculator or excel to compute. do not round until your final answers. round each answer to the nearest whole number.)

Answers: 2

Business, 22.06.2019 15:40, Zachary429

Brandt enterprises is considering a new project that has a cost of $1,000,000, and the cfo set up the following simple decision tree to show its three most likely scenarios. the firm could arrange with its work force and suppliers to cease operations at the end of year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. how much is the option to abandon worth to the firm?

Answers: 1

Do you know the correct answer?

Assume the perpetual inventory system is used unless stated otherwise. accounting for inventory usin...

Questions in other subjects:

Mathematics, 10.12.2020 07:40

Mathematics, 10.12.2020 07:40

Mathematics, 10.12.2020 07:40