Business, 26.12.2019 23:31, beesbutterflyqueen

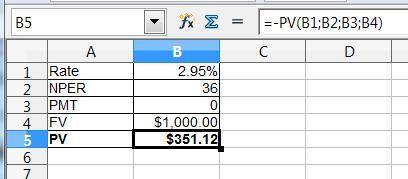

Deltona motors just issued 230,000 zero-coupon bonds. these bonds mature in 18 years, have a par value of $1,000, and have a yield to maturity of 5.9 percent. what is the approximate total amount of money the company raised from issuing these bonds?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:20, pwolfiimp4

Which feature transfers a slide show into a word-processing document?

Answers: 2

Business, 22.06.2019 03:30, jonathanLV6231

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 06:30, silas99

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

Business, 22.06.2019 07:00, Maria3737

For the past six years, the price of slippery rock stock has been increasing at a rate of 8.21 percent a year. currently, the stock is priced at $43.40 a share and has a required return of 11.65 percent. what is the dividend yield? 3.20 percent 2.75 percent 3.69 percent

Answers: 3

Do you know the correct answer?

Deltona motors just issued 230,000 zero-coupon bonds. these bonds mature in 18 years, have a par val...

Questions in other subjects:

Mathematics, 28.07.2020 22:01

Mathematics, 28.07.2020 22:01

Mathematics, 28.07.2020 22:01

English, 28.07.2020 22:01