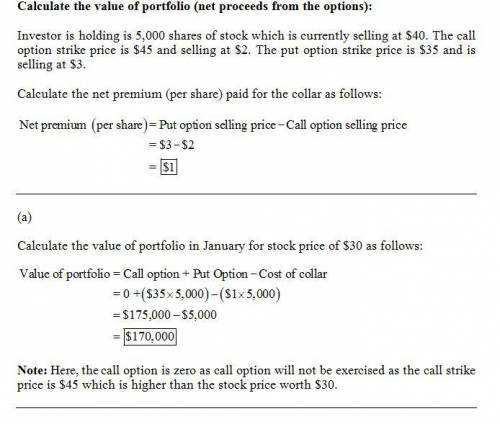

Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. you are ready to sell the shares but would prefer to put off the sale until next year for tax reasons. if you continue to hold the shares until january, however, you face the risk that the stock will drop in value before year end. you decide to use a collar to limit downside risk without laying out a good deal of additional funds. january call options with a strike of $45 are selling at $2, and january puts with a strike price of $35 are selling at $3. assume that you hedge the entire 5,000 shares of stock.

(a)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $30. (omit the "$" sign in your response.)

stock price $

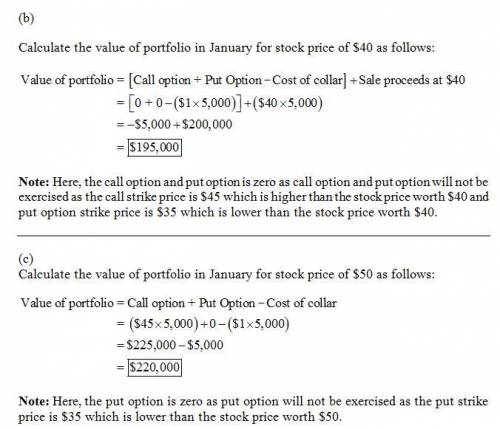

(b)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $40? (omit the "$" sign in your response.)

stock price $

(c)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $50? (omit the "$" sign in your response.)

stock price $

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:40, aamavizca

Maria am corporation uses the weighted-average method in its process costing system. the baking department is one of the processing departments in its strudel manufacturing facility. in june in the baking department, the cost of beginning work in process inventory was $4,880, the cost of ending work in process inventory was $1,150, and the cost added to production was $25,200. required: prepare a cost reconciliation report for the baking department for june.

Answers: 2

Business, 22.06.2019 12:00, elianagilbert3p3hh63

Areal estate agent is considering changing her cell phone plan. there are three plans to choose from, all of which involve a monthly service charge of $20. plan a has a cost of $.42 a minute for daytime calls and $.17 a minute for evening calls. plan b has a charge of $.52 a minute for daytime calls and $.15 a minute for evening calls. plan c has a flat rate of $80 with 275 minutes of calls allowed per month and a charge of $.38 per minute beyond that, day or evening. a. determine the total charge under each plan for this case: 150 minutes of day calls and 70 minutes of evening calls in a month. (do not round intermediate calculations. round your answer to 2 decimal places. omit the "$" sign in your response.)c. if the agent will use the service for daytime calls, over what range of call minutes will each plan be optimal? (round each answer to the nearest whole number. include the indifference point itself in each answer.)d. suppose that the agent expects both daytime and evening calls. at what point (i. e., percentage of total call minutes used for daytime calls) would she be indifferent between plans a and b?

Answers: 1

Business, 22.06.2019 18:30, thomaskilajuwon

Afarmer is an example of what kind of producer?

Answers: 2

Business, 22.06.2019 19:30, taylorray0820

Which of the following statements are false regarding activity-based costing? non-manufacturing costs are important to include when calculating the cost of each product. costs are allocated based on a pre-determined overhead rate. transitioning from traditional costing methods to activity-based costing can be complicated and costly. activity-based costing follows the same basic calculation methods as traditional costing approaches. none of the above

Answers: 2

Do you know the correct answer?

Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. you are read...

Questions in other subjects:

Biology, 14.09.2021 05:10

Chemistry, 14.09.2021 05:10

Biology, 14.09.2021 05:10

Computers and Technology, 14.09.2021 05:10

Mathematics, 14.09.2021 05:10

Biology, 14.09.2021 05:10