Business, 25.12.2019 03:31, domenica19

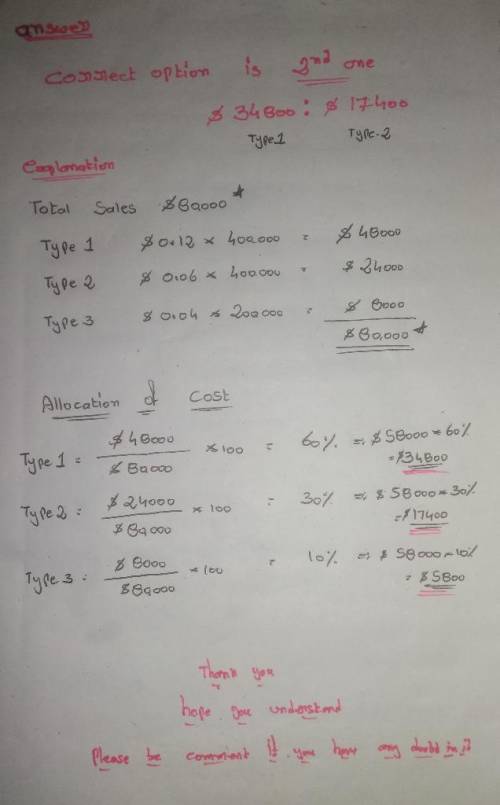

Alumber mill bought a shipment of logs for $58,000. when cut, the logs produced a million board feet of lumber in the following grades. compute the cost to be allocated to type 1 and type 2 lumber, respectively, if the value basis is used. (do not round your intermediate calculations.) type 1 - 400,000 bd. ft. priced to sell at $0.12 per bd. ft. type 2 - 400,000 bd. ft. priced to sell at $0.06 per bd. ft. type 3 - 200,000 bd. ft. priced to sell at $0.04 per bd. ft. multiple choice $58,000; $24,000. $34,800; $17,400. $10,944; $5,800. $24,000; $8,000. $16,000; $16,000.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 09:40, nessross1018

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 19:40, madisynk78

Adistinguishing feature of ecological economics is the concept of cost-benefit analysis steady-state economies that, like natural systems, neither grow nor shrink environmental damage and also environmental benefits are external greenwashing to increase public acceptance of products the only healthy economy is one that is growing

Answers: 1

Business, 22.06.2019 19:40, thomasalmo2014

On april 1, santa fe, inc. paid griffith publishing company $2,448 for 36-month subscriptions to several different magazines. santa fe debited the prepayment to a prepaid subscriptions account, and the subscriptions started immediately. what amount should appear in the prepaid subscription account for santa fe, inc. after adjustments on december 31 of the first year assuming the company is using a calendar-year reporting period and no previous adjustment has been made?

Answers: 1

Business, 22.06.2019 23:30, hehefjf3854

Miller company’s total sales are $171,000. the company’s direct labor cost is $20,520, which represents 30% of its total conversion cost and 40% of its total prime cost. its total selling and administrative expense is $25,650 and its only variable selling and administrative expense is a sales commission of 5% of sales. the company maintains no beginning or ending inventories and its manufacturing overhead costs are entirely fixed costs. required: 1. what is the total manufacturing overhead cost? 2. what is the total direct materials cost? 3. what is the total manufacturing cost? 4. what is the total variable selling and administrative cost? 5. what is the total variable cost? 6. what is the total fixed cost? 7. what is the total contribution margin?

Answers: 3

Do you know the correct answer?

Alumber mill bought a shipment of logs for $58,000. when cut, the logs produced a million board feet...

Questions in other subjects:

Mathematics, 14.09.2019 21:10

Spanish, 14.09.2019 21:10