The yurdone corporation wants to set up a private cemetery business. according to the cfo, barry m. deep, business is "looking up". as a result, the cemetery project will provide a net cash inflow of $101,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 3 percent per year forever. the project requires an initial investment of $1,540,000.

a-1

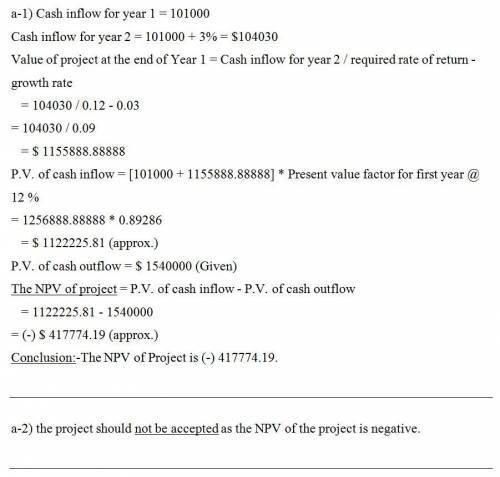

what is the npv for the project if yurdone's required return is 12 percent? (negative amount should be indicated by a minus sign. do not round intermediate calculations and round your final answer to 2 decimal places. (e. g., 32.16))

npv $

a-2

if yurdone requires a return of 12 percent on such undertakings, should the firm accept or reject the project?

reject

accept

b.

the company is somewhat unsure about the assumption of a 3 percent growth rate in its cash flows. at what constant growth rate would the company just break even if it still required a return of 12 percent on investment? (round your answer to 2 decimal places. (e. g., 32.16))

constant growth rate %

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:10, hausofharris

Karen is working on classifying all her company’s products in terms of whether they have strong or weak market share and whether this share is in a slow or growing market. what type of strategic framework is she using?

Answers: 2

Business, 22.06.2019 11:40, sabrinabowers4308

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

Business, 22.06.2019 11:40, nelly88

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

Business, 22.06.2019 12:10, gingerham1

Laws corporation is considering the purchase of a machine costing $16,000. estimated cash savings from using the new machine are $4,120 per year. the machine will have no salvage value at the end of its useful life of six years and the required rate of return for laws corporation is 12%. the machine's internal rate of return is closest to (ignore income taxes) (a) 12% (b) 14% (c) 16% (d) 18%

Answers: 1

Do you know the correct answer?

The yurdone corporation wants to set up a private cemetery business. according to the cfo, barry m....

Questions in other subjects:

Health, 02.01.2021 09:30

Mathematics, 02.01.2021 09:30

Health, 02.01.2021 09:40

Chemistry, 02.01.2021 09:40