Business, 24.12.2019 00:31, sriharin58ozhj9m

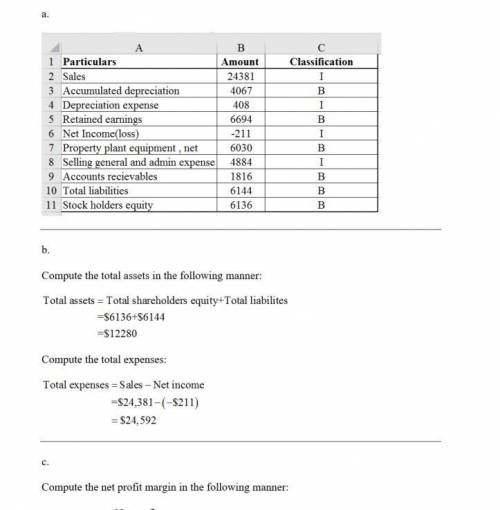

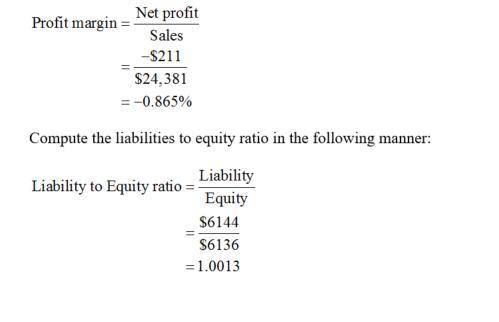

Identifying and classifying balance sheet and income statement accountsfollowing are selected accounts for staples, inc., for the fiscal year ended february 2, 2013(a) indicate whether each account appears on the balance sheet (b) or income statement (i).staples, inc. ($ millions) amount classificationsales $24,381 iaccumulated depreciation 4,067 bdepreciation expense 408 iretained earnings 6,694 b net income (loss) (211) iproperty, plant & equipment, net 6,030 bselling, general and admin expense 4,884 iaccounts receivable 1,816 btotal liabilities 6,144 bstockholders' equity 6,136 b(b) using the data, compute total assets and total expenses. i. total assetsii. total expenses(c) compute net profit margin (net income/sales) and total liabilities-to-equity ratio (total liabilities/stockholders' equity). (round your answers to two decimal places.)i. net profit marginii. total liabilities-to-equity ratio

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:40, gobertbrianna40

Job a3b was ordered by a customer on september 25. during the month of september, jaycee corporation requisitioned $2,400 of direct materials and used $3,900 of direct labor. the job was not finished by the end of the month, but needed an additional $2,900 of direct materials in october and additional direct labor of $6,400 to finish the job. the company applies overhead at the end of each month at a rate of 100% of the direct labor cost. what is the amount of job costs added to work in process inventory during october?

Answers: 3

Business, 22.06.2019 06:00, olivernolasco23

Josie just bought her first fish tank a 36 -gallon glass aquarium, which she’s been saving up for almost a year to buy. for josie, the fish tank is most likely what type of purchase

Answers: 1

Business, 22.06.2019 10:50, Nicki3729

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 20:50, arturocarmena10

Which of the following is an example of a monetary policy? a. the government requires credit card companies to protect customers' privacy. b. the government restricts the amount of money that banks can lend. c. the government lowers taxes and increases spending. d. the government pays for repairing damage from a natural disaster.

Answers: 1

Do you know the correct answer?

Identifying and classifying balance sheet and income statement accountsfollowing are selected accoun...

Questions in other subjects:

Mathematics, 19.05.2020 15:14

English, 19.05.2020 15:14

Mathematics, 19.05.2020 15:14

History, 19.05.2020 15:14