Business, 21.12.2019 05:31, eyeneedalife

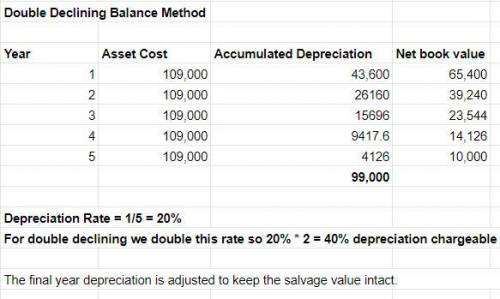

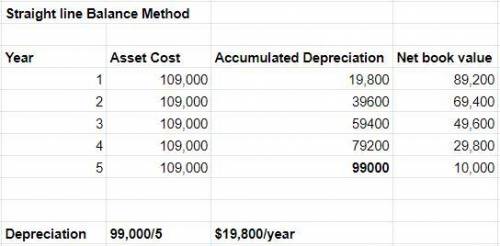

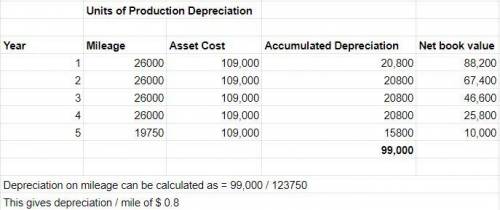

On january 2, 2018, nimble delivery service purchased a truck at a cost of $ 95 comma 000. before placing the truck in service, nimble spent $ 4 comma 000 painting it, $ 2 comma 500 replacing tires, and $ 7 comma 500 overhauling the engine. the truck should remain in service for five years and have a residual value of $ 10 comma 000. the truck's annual mileage is expected to be 26 comma 000 miles in each of the first four years and 19 comma 750 miles in the fifth yearlong dash123 comma 750 miles in total. in deciding which depreciation method to use, steven kittridge, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance).requireme nts 1. prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. rapid prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use, consider the first year that rapid uses the truck. identify the depreciation method that meets the company's objectives.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:30, tdyson3p6xvtu

The dollar value generated over decades of customer loyalty to your company is known as brand equity. viability. sustainability. luck.

Answers: 1

Business, 22.06.2019 04:00, tomboyswagge2887

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

Business, 22.06.2019 10:30, pierrezonra

What are the positive environmental trends seen today? many industries are taking measures to reduce the use( _gold, carbon dioxide, ozone_) of -depleting substances and are turning to(_scarce, renewable, non-recyclable_) energy sources though they may seem expensive. choose one of those 3 option to fill the

Answers: 3

Business, 22.06.2019 11:20, tatilynnsoto17

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year. a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs. b. calculate the eoq. c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Do you know the correct answer?

On january 2, 2018, nimble delivery service purchased a truck at a cost of $ 95 comma 000. before pl...

Questions in other subjects:

Mathematics, 23.07.2019 23:00

Mathematics, 23.07.2019 23:00

History, 23.07.2019 23:00

Mathematics, 23.07.2019 23:00

Mathematics, 23.07.2019 23:00