Business, 21.12.2019 02:31, gutierrezaandrea56

Assume that your parents wanted to have $ 130,000 saved for college by your 18th birthday and they started saving on your first birthday. they saved the same amount each year on your birthday and earned 5.5 % per year on their investments.

(a) how much would they have to save each year to reach their goal?

(b) if they think you will take five years instead of four to graduate and decide to have $ 170,000 saved just in case, how much would they have to save each year to reach their new goal?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:30, maxicanofb0011

Based on the supply and demand theory, why do medical doctors earn higher wages than child-care workers?

Answers: 1

Business, 22.06.2019 04:30, hannahkelly3618

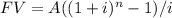

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 09:40, ameliaduxha7

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Do you know the correct answer?

Assume that your parents wanted to have $ 130,000 saved for college by your 18th birthday and they s...

Questions in other subjects:

Chemistry, 22.10.2021 20:10

Mathematics, 22.10.2021 20:10

Mathematics, 22.10.2021 20:10

History, 22.10.2021 20:10

Mathematics, 22.10.2021 20:10

English, 22.10.2021 20:10

Biology, 22.10.2021 20:10