Business, 20.12.2019 20:31, archersmithdrag

Gekko, inc. reported the following balances (after adjustment) at the end of 2008 and 2007.

12/31/2008 12/31/2007

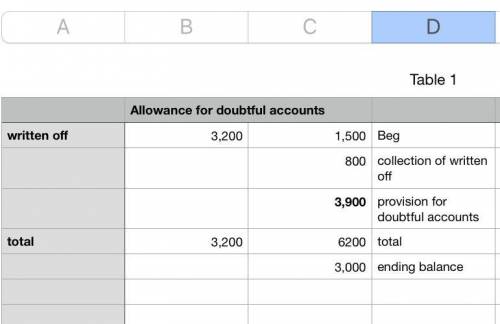

total accounts receivable p105,000 p96,000

net accounts receivable 102,000 94,500

during 2008, gekko wrote off customer accounts totaling p3,200 and collected p800 on accounts written off in previous years. gekko's doubtful accounts expense for the year ending december 31, 2008 is

(a) p1,500.

(b) p2,400.

(c) p3,000.

(d) p3,900.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:10, crzyemo865

Calculating and interpreting eps information wells fargo reports the following information in its 2015 form 10-k. in millions 2015 2014 wells fargo net income $24,005 $24,168 preferred stock dividends $1,535 $1,347 common stock dividends $7,400 $6,908 average common shares outstanding 5,136.5 5,237.2 diluted average common shares outstanding 5,209.8 5,324.4 determine wells fargo's basic eps for fiscal 2015 and for fiscal 2014. round answers to two decimal places.

Answers: 3

Business, 22.06.2019 19:50, lucky1940

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

Business, 22.06.2019 22:30, aaroneduke558

Perry is a freshman, he estimates that the cost of tuition, books, room and board, transportation, and other incidentals will be $30000 this year. he expects these costs to rise about $1500 each year while he is in college. if it will take him 5 years to earn his bs, what is the present cost of his degree at an interest rate of 6%? if he earns and extra $10000 annually for 40 years, what is the present worth of his degree.?

Answers: 3

Business, 23.06.2019 01:50, katelynbychurch

Consider a firm with a contract to sell an asset for $149,000 four years from now. the asset costs $85,000 to produce today. a. given a relevant discount rate of 14 percent per year, calculate the profit the firm will make on this asset. (a loss should be indicated by a minus sign. do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. at what rate does the firm just break even?

Answers: 3

Do you know the correct answer?

Gekko, inc. reported the following balances (after adjustment) at the end of 2008 and 2007.

Questions in other subjects:

Mathematics, 02.04.2020 23:24

Mathematics, 02.04.2020 23:24

English, 02.04.2020 23:24

Mathematics, 02.04.2020 23:24

Mathematics, 02.04.2020 23:24