Business, 19.12.2019 22:31, alexis1246

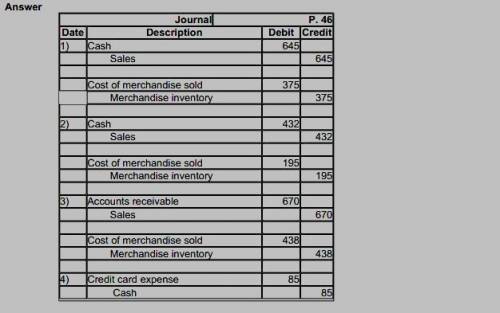

The following are the transactions for evans company: a. sold merchandise for $645. the cost of goods sold was $375. b. sold merchandise for $432 and accepted visa as the form of payment. the cost of goods sold was $195. c. sold merchandise on account for $670. the cost of goods sold was $438. d. paid credit card fees for the month of $85.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:40, annahm3173

In the fall of 2008, aig, the largest insurance company in the world at the time, was at risk of defaulting due to the severity of the global financial crisis. as a result, the u. s. government stepped in to support aig with large capital injections and an ownership stake. how would this affect, if at all, the yield and risk premium on aig corporate debt?

Answers: 3

Business, 22.06.2019 19:40, apodoltsev2021

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

Business, 22.06.2019 21:50, sippincoronas

Q3. loral corporation manufactures parts for an aircraft company. it uses a computerized numerical controlled (cnc) machining center to produce a specific part that has a design (nominal) target of 1.275 inches with tolerances of ± 0.020 inch. the cnc process that manufactures these parts has a mean of 1.285 inches and a standard deviation of 0.005 inch. compute the process capability ratio and process capability index, and comment on the overall capability of the process to meet the design specifications.

Answers: 1

Business, 22.06.2019 22:00, toxsicity

Which of the following statements about nonverbal communication is most accurate? a. the meanings of some gestures can vary among cultures b. the way an e-mail, letter, memo, or report looks can have either a positive or a negative effect on a receiver c. the manner in which we structure and use time can reveal our personalities and attitudes d. all statements are accurate

Answers: 1

Do you know the correct answer?

The following are the transactions for evans company: a. sold merchandise for $645. the cost of goo...

Questions in other subjects:

Mathematics, 03.05.2021 22:40

Mathematics, 03.05.2021 22:40

Health, 03.05.2021 22:40

Mathematics, 03.05.2021 22:40