Business, 19.12.2019 03:31, tommyaberman

Brad and angelina are a wealthy couple who have three children, fred, bridget, and lisa. two of the three children, fred and bridget, are from brad’s previous marriages. on christmas this year, brad gave each of the three children a cash gift of $6,500, and angelina gave lisa an additional cash gift of $41,000. brad also gave stock worth $54,000 (adjusted basis of $13,500) to the actor’s guild (an "a" charity).

(leave no answer blank. enter zero if applicable.)

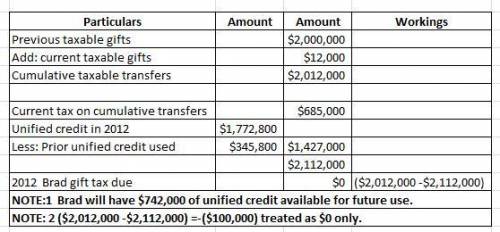

a. brad and angelina have chosen to split gifts. calculate brad’s gift tax. assume that angelina has no previous taxable gifts, but brad reported previous taxable gifts of $2 million in 2009 when he used $345,800 of unified credit and paid $435,000 of gift taxes. (reference the tax rate schedule in exhibit 25-1 and the unified credit schedule in exhibit 25-2 to answer this problem.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 18:10, Annabeans1105

Grace period is a period of time before the credit card company starts charging late fees. truefalse

Answers: 1

Business, 22.06.2019 11:20, murarimenon

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

Do you know the correct answer?

Brad and angelina are a wealthy couple who have three children, fred, bridget, and lisa. two of the...

Questions in other subjects:

Mathematics, 08.01.2021 18:30

Mathematics, 08.01.2021 18:30

History, 08.01.2021 18:30

Mathematics, 08.01.2021 18:30

Mathematics, 08.01.2021 18:30