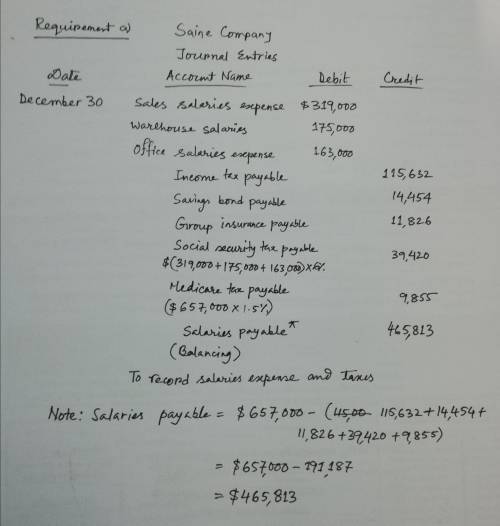

The following information about the payroll for the week ended december 30 was obtained from the records of saine co.: salaries: deductions: sales salaries $319,000 income tax withheld $115,632 warehouse salaries 175,000 u. s. savings bonds 14,454 office salaries 163,000 group insurance 11,826 $657,000 tax rates assumed: social security, 6% medicare, 1.5% state unemployment (employer only), 5.4% federal unemployment (employer only), 0.8%

Answers: 1

Other questions on the subject: Business

Business, 23.06.2019 22:30, cluchmasters5634

In a suit by the national forest preservation organization (nfpo) against old growth logging, inc., nfpo serves a written request for old growth to admit the truth of matters relating to the trial. old growth's admission in response is the equivalent of

Answers: 3

Business, 23.06.2019 23:00, preciadogabriel40

Ocean co. has paid a dividend $2 per share out of earnings of $4 per share. if the book value per share is $25, what is the expected growth rate in dividends (g)?

Answers: 1

Business, 24.06.2019 01:00, iceyburh

Helen holds 1,000 shares of fizbo inc. stock that she purchased 11 months ago. the stock has done very well and has appreciated $20/share since helen bought the stock. when sold, the stock will be taxed at capital gains rates (the long-term rate is 15 percent and the short-term rate is the taxpayer's marginal tax rate). ignore the time value of money.

Answers: 3

Do you know the correct answer?

The following information about the payroll for the week ended december 30 was obtained from the rec...

Questions in other subjects:

Biology, 30.08.2019 16:20

Mathematics, 30.08.2019 16:20

Mathematics, 30.08.2019 16:20

History, 30.08.2019 16:20

Computers and Technology, 30.08.2019 16:20

Mathematics, 30.08.2019 16:20