Business, 18.12.2019 06:31, kornut5536

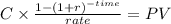

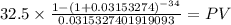

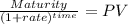

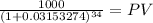

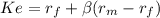

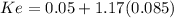

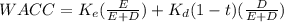

Consider the following information for evenflow power co., debt: 5,000 6.5 percent coupon bonds outstanding, $1,000 par value, 17 years to maturity, selling for 102 percent of par; the bonds make semiannual payments. common stock: 105,000 shares outstanding, selling for $59 per share; the beta is 1.17. preferred stock: 18,000 shares of 6 percent preferred stock outstanding, currently selling for $105 per share. market: 8.5 percent market risk premium and 5 percent risk-free rate. assume the company's tax rate is 34 percent. what is the company's wacc?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 00:30, joshdunsbuns143

How did lani lazzari show her investors she was a good investment? (site 1)

Answers: 3

Business, 22.06.2019 06:40, anatomyfl

At april 1, 2019, the food and drug administration is in the process of investigating allegations of false marketing claims by hulkly muscle supplements. the fda has not yet proposed a penalty assessment. hulkly’s fiscal year ends on december 31, 2018. the company’s financial statements are issued in april 2019. required: for each of the following scenarios, determine the appropriate way to report the situation. 1. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 2. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is probable. 3. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 4. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is probable.

Answers: 1

Business, 22.06.2019 09:40, bennett2968

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 12:20, Tierriny576

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

Do you know the correct answer?

Consider the following information for evenflow power co., debt: 5,000 6.5 percent coupon bonds out...

Questions in other subjects:

Health, 02.02.2020 10:45

Mathematics, 02.02.2020 10:45

Physics, 02.02.2020 10:45

Biology, 02.02.2020 10:45

Mathematics, 02.02.2020 10:45

Mathematics, 02.02.2020 10:45