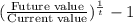

Assume a zero-coupon bond that sells for $270 and will mature in 25 years at $1,850. use appendix b for an approximate answer but calculate your final answer using the formula and financial calculator methods. what is the effective yield to maturity? (assume annual compounding. do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Other questions on the subject: Business

Business, 23.06.2019 01:00, bugsbunny27

Weekly sales at nancy's restaurant total $ 84,000. labor required is 420 hours at a cost of $21,000. raw materials used amount to $40,000. what is the partial measure of productivity for labor hours?

Answers: 1

Business, 23.06.2019 02:30, winterblanco

How is the role of government determined in the american free enterprise system?

Answers: 2

Business, 23.06.2019 04:00, jasmine2531

Asmall company has 10,000 shares. joan owns 200 of these shares. the company decided to split its shares. what is joan's ownership percentage after the split

Answers: 2

Do you know the correct answer?

Assume a zero-coupon bond that sells for $270 and will mature in 25 years at $1,850. use appendix b...

Questions in other subjects:

Biology, 01.10.2019 21:00

Mathematics, 01.10.2019 21:00

History, 01.10.2019 21:00

Chemistry, 01.10.2019 21:00