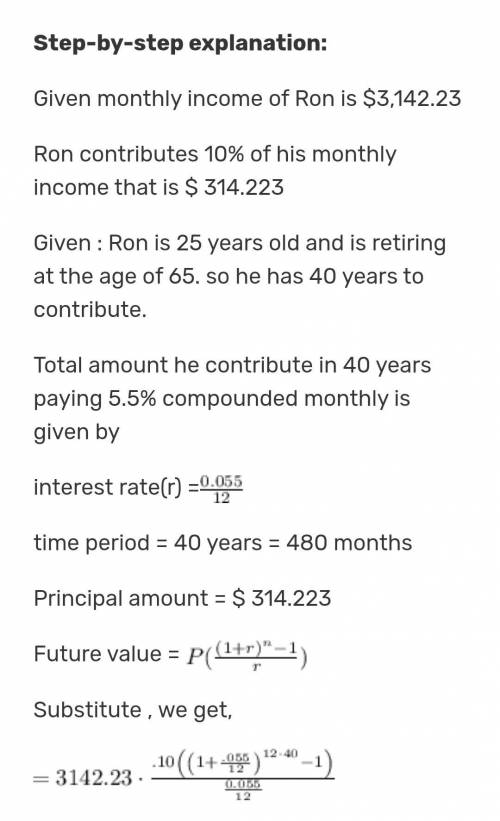

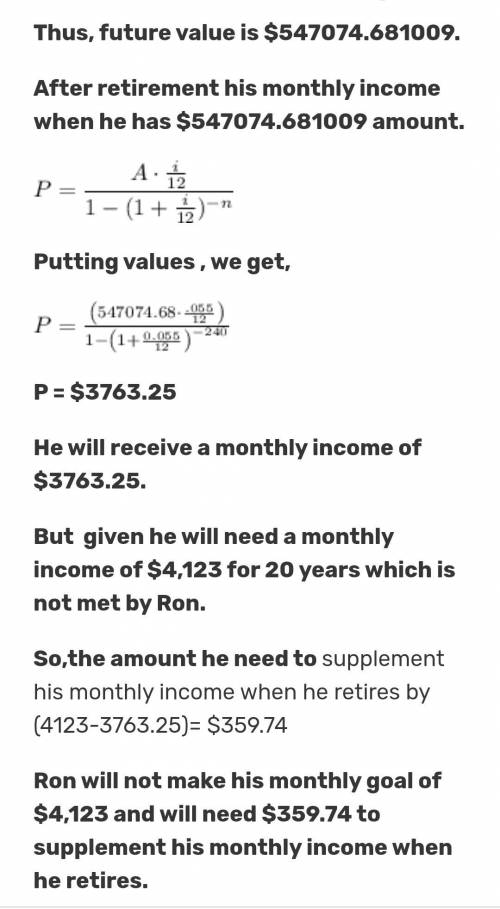

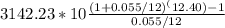

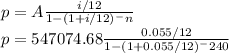

Ron is 25 years old and is retiring at the age of 65. when he retires, he will need a monthly income of $4,123 for 20 years. if ron contributes 10% of his monthly income to a 401(k) paying 5.5% compounded monthly, will he reach his goal for retirement given that his monthly income is 3,142.23? if he does not make his goal then state by what amount he will need to supplement his income. round all answers to the nearest cent. a.ron will meet his monthly goal of exactly $4,123 for retirement. b.ron will meet his monthly goal of $4,123 for retirement with an excess of $125.34.c. ron will not make his monthly goal of $4,123 and will need $359.74 to supplement his monthly income when he retires. d.ron will not make his monthly goal of $4,123 and will need $450.61 to supplement his monthly income when he retires.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 18:20, nicollexo21

Alyeska services company, a division of a major oil company, provides various services to the operators of the north slope oil field in alaska. data concerning the most recent year appear below: sales $18,000,000 net operating income $6,300,000 average operating assets $35,200,000 1. compute the margin for alyeska services company. (round your answer to 2 decimal places.) 2. compute the turnover for alyeska services company. (round your answer to 2 decimal places.) 3. compute the return on investment (roi) for alyeska services company. (round your intermediate calculations and final answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 04:40, mswillm

Dahlia enterprises needs someone to supply it with 127,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you’ve decided to bid on the contract. it will cost you $940,000 to install the equipment necessary to start production; you’ll depreciate this cost straight-line to zero over the project’s life. you estimate that in five years, this equipment can be salvaged for $77,000. your fixed production costs will be $332,000 per year, and your variable production costs should be $11.00 per carton. you also need an initial investment in net working capital of $82,000. if your tax rate is 30 percent and your required return is 11 percent on your investment, what bid price should you submit? (do not round intermediate calculations and round your final answer to 2 decimal places. (e. g., 32.16))

Answers: 3

Business, 22.06.2019 10:20, Sparkledog

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 11:00, smartie80

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Do you know the correct answer?

Ron is 25 years old and is retiring at the age of 65. when he retires, he will need a monthly income...

Questions in other subjects:

Chemistry, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Health, 27.10.2020 01:00

Business, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Geography, 27.10.2020 01:00