Business, 14.12.2019 05:31, greeneashlynt

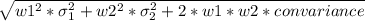

Assume there is a fixed exchange rate between the canadian and u. s. dollar. the expected return and standard deviation of return on the u. s. stock market are 18% and 15%, respectively. the expected return and standard deviation on the canadian stock market are 13% and 20%, respectively. the covariance of returns between the u. s. and canadian stock markets is 1.5%.if you invested 50% of your money in the canadianstock market and 50% in the u. s. stock market, the standard deviation of return of your portfolio would be

a.12.53%.

b. 15.21%.

c. 17.50%.

d. 18.75%.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 21:50, edgarsandoval60

By which distribution system is more than 90 percent of u. s. coal shipped? a. pipelinesb. trucksc. waterwaysd. railroadse. none of the above

Answers: 1

Business, 23.06.2019 15:30, QuestionsAnsweredNow

Describe a least two factors that a lender would consider if you applied for a business loan.

Answers: 2

Business, 24.06.2019 08:30, keyshawn437

Upgrade realty typically sells houses valued between $150,000 to $300,000. however, they just listed an upscale property for $7,875,000. what would be a good advertising medium to utilize to sell this pricey home?

Answers: 3

Do you know the correct answer?

Assume there is a fixed exchange rate between the canadian and u. s. dollar. the expected return and...

Questions in other subjects:

Mathematics, 08.01.2021 23:10

German, 08.01.2021 23:10

Mathematics, 08.01.2021 23:10

Mathematics, 08.01.2021 23:10

English, 08.01.2021 23:10

................1

................1