Business, 14.12.2019 02:31, ryleepretty

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target capital structure. currently it targets a 50-50 mix of debt and equity, but it is considering a target capital structure with 70% debt. american exploration currently has 6% after-tax cost of debt and a 12% cost of common stock. the company does not have any preferred stock outstanding.

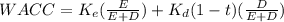

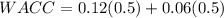

a. what is american exploration's current wacc?

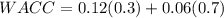

b. assuming that its cost of debt and equity remain unchanged, what will be american exploration's wacc under the revised target capital structure?

c. do you think shareholders are affected by the increase in debt to 70%? if so, how are they affected? are the common stock claims riskier now?

d. suppose that in response to the increase in debt, american exploration's shareholders increase their required return so that cost of common equity is 16%. what will its new wacc be in this case?

e. what does your answer in part d suggest about the tradeoff between financing with debt versus equity?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:10, henryzx900

How much are you willing to pay for a zero that matures in 10 years, has a face value of $1,000 and your required rate of return is 7%? round to the nearest cent. do not include a dollar sign in your answer. (i. e. if your answer is $432.51, then type 432.51 without $ sign)

Answers: 1

Business, 22.06.2019 11:30, laylay120

You've arrived at the pecan shellers conference—your first networking opportunity. naturally, you're feeling nervous, but to avoid seeming insecure or uncertain, you've decided to a. speak a little louder than you would normally. b. talk on your cell phone as you walk around. c. hold an empowered image of yourself in your mind. d. square your shoulders before entering the room.

Answers: 2

Business, 22.06.2019 11:30, fjjjjczar8890

Which of the following statements about cash basis accounting is true? a. it is more complicated than accrual basis accounting. b. the irs allows all types of corporations to use it. c. it follows gaap standards. d. it ensures the company always knows how much cash flow it has.

Answers: 2

Business, 22.06.2019 15:20, ashleyuchiha123

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Do you know the correct answer?

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target...

Questions in other subjects:

Mathematics, 03.02.2020 06:52

Biology, 03.02.2020 06:52

Health, 03.02.2020 06:52

Business, 03.02.2020 06:52