Business, 14.12.2019 00:31, marainafolta

Product pricing: single product presented is the 2017 contribution income statement of grafton products. grafton products contribution income statement for year ended december 31, 2017 sales (13,000 units) $ 2,925,000 less variable costs cost of goods sold $ 780,000 selling and administrative 208,000 (988,000) contribution margin 1,937,000 less fixed costs manufacturing overhead 780,000 selling and administrative 315,000 (1,095,000) net income $ 842,000 during the coming year, grafton expects an increase in variable manufacturing costs of $12 per unit and in fixed manufacturing costs of $39,000.

a. if sales for 2018 remain at 13,000 units, what price should grafton charge to obtain the same profit

as last year?

b. management believes that sales can be increased to 16,000 units if the selling price is lowered to

$200. is this action desirable?

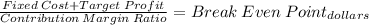

c. after considering the expected increases in costs, what sales volume is needed to earn a profit of

$254,800 with a unit selling price of $200?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 15:30, shaelyn0920

Walter wants to deposit $1,500 into a certificate of deposit at the end of each ofthe next 6 years. the deposits will earn 5 percent compound annual interest. ifwalter follows through with his plan, approximately how much will be in his accountimmediately after the sixth deposit is made?

Answers: 1

Business, 22.06.2019 07:30, kennaklein2

When selecting a savings account, you should look at the following factors except annual percentage yield (apy) fees minimum balance interest thresholds taxes paid on the interest variable interest rates

Answers: 1

Business, 22.06.2019 08:30, rajenkins79

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

Business, 22.06.2019 18:10, zaratayyibah

Ashop owner uses a reorder point approach to restocking a certain raw material. lead time is six days. usage of the material during lead time is normally distributed with a mean of 42 pounds and a standard deviation of four pounds. when should the raw material be reordered if the acceptable risk of a stockout is 3 percent?

Answers: 1

Do you know the correct answer?

Product pricing: single product presented is the 2017 contribution income statement of grafton prod...

Questions in other subjects:

Mathematics, 10.06.2020 21:57