Business, 12.12.2019 05:31, julieariscar769

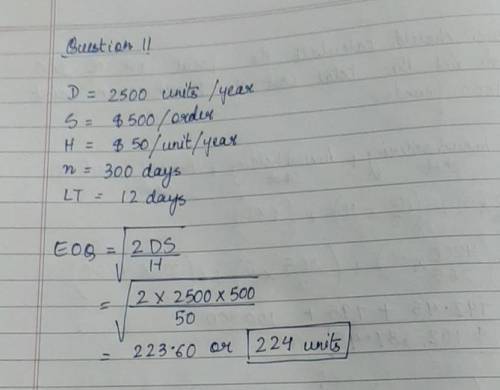

An appliance store carries a specialty model of microwave ovens. the demand for the microwave oven is relatively constant at 2500 units per year. placing an order costs the store $500 regardless the quantity ordered. carrying one unit over a one year period costs the store $50. the store opens 300 days per year and the lead time for this item is 12 working days. because of the special features of the microwave oven, customers may buy it whether it is currently available in the store. hence, the store is considering selling it on a back order basis if it is beneficial. it is estimated that one unit on back order for a one year period costs the store $150. assuming the inventory policy of the appliance store does not allow stock out, determine total annual relevant, including the ordering and holding, cost.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:30, strikeboystorm

White company has two departments, cutting and finishing. the company uses a job-order costing system and computes a predetermined overhead rate in each department. the cutting department bases its rate on machine-hours, and the finishing department bases its rate on direct labor-hours. at the beginning of the year, the company made the following estimates: department cutting finishing direct labor-hours 6,000 30,000 machine-hours 48,000 5,000 total fixed manufacturing overhead cost $ 264,000 $ 366,000 variable manufacturing overhead per machine-hour $ 2.00 " variable manufacturing overhead per direct labor-hour " $ 4.00 required: 1. compute the predetermined overhead rate for each department. 2. the job cost sheet for job 203, which was started and completed during the year, showed the following: department cutting finishing direct labor-hours 6 20 machine-hours 80 4 direct materials $ 500 $ 310 direct labor cost $ 108 $ 360 using the predetermined overhead rates that you computed in requirement (1), compute the total manufacturing cost assigned to job 203. 3. would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined overhead rate based on direct labor-hours, rather than using departmental rates?

Answers: 3

Business, 22.06.2019 21:00, QueenMiah16

Sue peters is the controller at vroom, a car dealership. dale miller recently has been hired as the bookkeeper. dale wanted to attend a class in excel spreadsheets, so sue temporarily took over dale's duties, including overseeing a fund used for gas purchases before test drives. sue found a shortage in the fund and confronted dale when he returned to work. dale admitted that he occasionally uses the fund to pay for his own gas. sue estimated the shortage at $450. what should sue do?

Answers: 3

Business, 22.06.2019 23:00, shifaxoxoxo

What is the purpose of the us international trade association?

Answers: 2

Do you know the correct answer?

An appliance store carries a specialty model of microwave ovens. the demand for the microwave oven i...

Questions in other subjects:

History, 21.12.2021 07:20

Mathematics, 21.12.2021 07:20

Mathematics, 21.12.2021 07:20

Biology, 21.12.2021 07:20

Chemistry, 21.12.2021 07:20