Business, 12.12.2019 04:31, milkshakegrande101

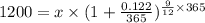

You are planning to send your child to a summer camp in 9 months. the camp will cost you $1,200 at that time. you have decided to invest a lump sum of money now that will grow to $1,200 by the time it is needed. assuming the money grows at a nominal annual interest rate of 12.2% compounded daily, how much money should you set aside now to have the funds available when needed?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 13:00, stelllllllllllllllla

Ronald works for a small biotech firm. when the firm presents the results of its clinical trials to the fda, ronald realizes that the results are not accurate. he reports this to the fda. ronald is a(n)

Answers: 3

Business, 22.06.2019 19:10, boi7348

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

Do you know the correct answer?

You are planning to send your child to a summer camp in 9 months. the camp will cost you $1,200 at t...

Questions in other subjects:

Chemistry, 17.05.2021 14:00

Advanced Placement (AP), 17.05.2021 14:10

Geography, 17.05.2021 14:10

Mathematics, 17.05.2021 14:10

History, 17.05.2021 14:10

Chemistry, 17.05.2021 14:10

Biology, 17.05.2021 14:10