Business, 12.12.2019 03:31, andrewmena05

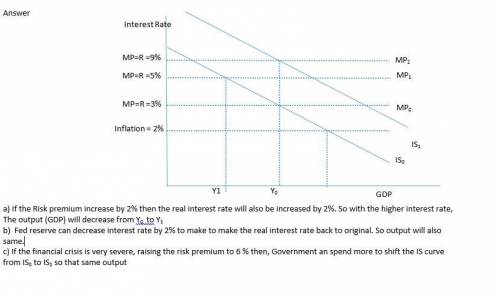

Afinancial crisis: suppose the economy starts with gdp at potential, the real interest rate and the marginal product of capital both equal to 3%, and a stable inflation rate of 2%. a mild financial crisis hits, that raises the risk premium from zero to 2%.

a. analyze the effect of this shock in an is/mp diagram.

b. what policy response would you recommend to the federal reserve? what would be the effect of this policy response on the economy?

c. how would your answer to part b) change if the financial crisis were very severe, raising the risk premium to 6%?

d. what other policy responses might be considered in this case?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 08:50, cmflores3245

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 10:50, jadeafrias

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 15:20, ashleyuchiha123

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 20:10, boofpack9775

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

Do you know the correct answer?

Afinancial crisis: suppose the economy starts with gdp at potential, the real interest rate and the...

Questions in other subjects:

English, 18.10.2020 05:01

Computers and Technology, 18.10.2020 05:01

Biology, 18.10.2020 05:01

History, 18.10.2020 05:01

Advanced Placement (AP), 18.10.2020 05:01