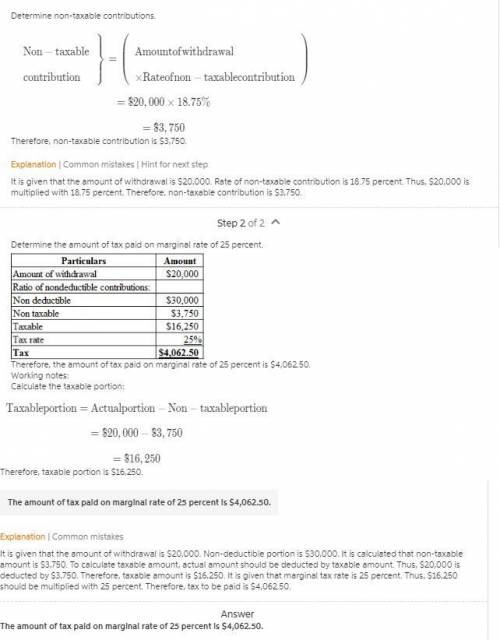

In 2019, rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional ira account. the balance of his ira account is $160,000 (before reducing it for withdrawals/distributions described below). over the years, rashaun has contributed $40,000 to the ira. of his $40,000 contributions, $30,000 was nondeductible and $10,000 was deductible. assume rashaun did not make any contributions to the account during 2019.a. if rashaun currently withdraws $20,000 from the ira, how much tax will he be required to pay on the withdrawal if his marginal tax rate is 25 percent?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:10, lucyamine0

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

Business, 22.06.2019 16:50, bandzlvr

Andrea cujoli is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market. currently the spot price for the japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$. andrea would earn a higher rate of return by buying yen and a forward contract than if she had invested her money in 6-month us treasury securities at an annual rate of 2.50%. true/false?

Answers: 2

Do you know the correct answer?

In 2019, rashaun (62 years old) retired and planned on immediately receiving distributions (making w...

Questions in other subjects:

Mathematics, 30.08.2019 08:50

Social Studies, 30.08.2019 08:50

Mathematics, 30.08.2019 08:50

Mathematics, 30.08.2019 08:50

Biology, 30.08.2019 08:50

Spanish, 30.08.2019 08:50

Social Studies, 30.08.2019 08:50

English, 30.08.2019 08:50