Business, 10.12.2019 01:31, advancedgamin8458

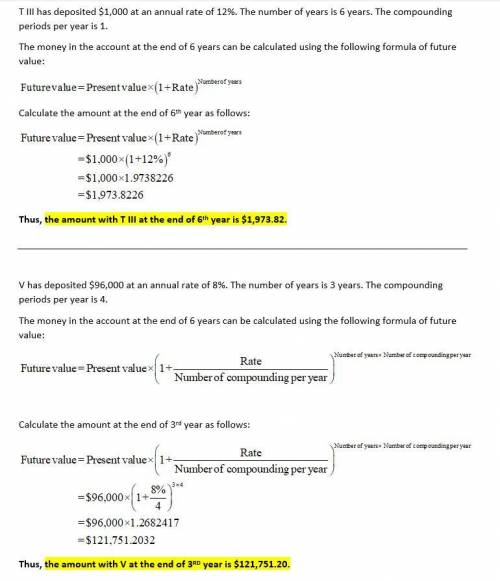

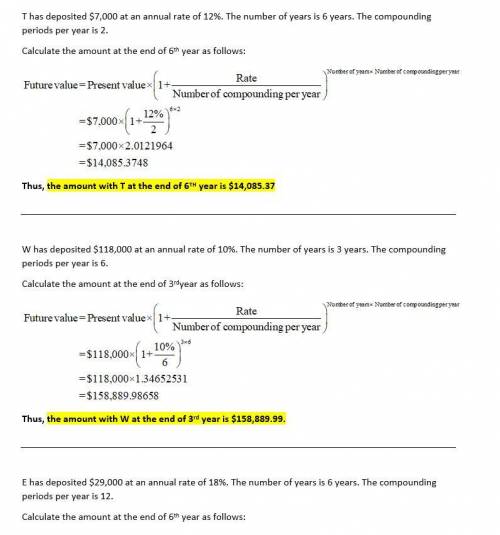

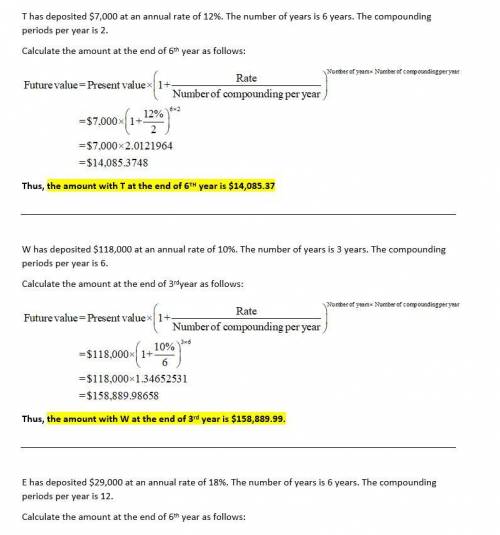

Compound interest with non-annual periods: calculate the amount of money that will be in each of the following accounts at the end of the given deposit periods: account holder, amount deposited, annual interest rate, compounding periods per year, compouding periodstheodore logan iii, 1000, 12%, 1, 6vernell coles, 96000, 8%, 4, 3tina elliot, 7000, 12%, 2, 6wayne robinson, 118000, 10%, 6, 3eunice chung, 29000, 18%, 12, 6kelly cravens, 15000, 8%, 3, 3the amount of money for theodore at end of 6 years is (i got $1973.82)? the amount of money for vernell at end of 3 years will be (i got $121751.21)the amount of money for tina at end of 6 years will be amount of money for wayne at end of 3 years will be amount of money for eunice at end of 6 years will be

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:20, BluSeaa

In 2007, americans smoked 19.2 billion packs of cigarettes. they paid an average retail price of $4.50 per pack. a. given that the elasticity of supply is 0.50.5 and the elasticity of demand is negative 0.4−0.4, derive linear demand and supply curves for cigarettes. the demand equation is qdequals=nothingplus+nothing times ×p and the supply equation is qsequals=nothingplus+nothing times ×p.

Answers: 2

Business, 22.06.2019 09:30, linnybear300

Any point on a country's production possibilities frontier represents a combination of two goods that an economy:

Answers: 3

Business, 22.06.2019 17:00, allofthosefruit

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 20:40, mom1645

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

Do you know the correct answer?

Compound interest with non-annual periods: calculate the amount of money that will be in each of th...

Questions in other subjects:

English, 12.03.2021 17:50

Mathematics, 12.03.2021 17:50

Mathematics, 12.03.2021 17:50

Mathematics, 12.03.2021 17:50

Social Studies, 12.03.2021 17:50

Mathematics, 12.03.2021 17:50