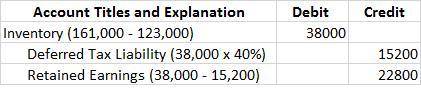

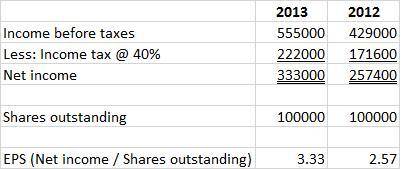

The cecil-booker vending company changed its method of valuing inventory from the average cost method to the fifo cost method at the beginning of 2013. at december 31, 2012, inventories were $123,000 (average cost basis) and were $127,000 a year earlier. cecil-booker’s accountants determined that the inventories would have totaled $161,000 at december 31, 2012, and $166,000 at december 31, 2011, if determined on a fifo basis. a tax rate of 40% is in effect for all years. one hundred thousand common shares were outstanding each year. income from continuing operations was $430,000 in 2012 and $555,000 in 2013. there were no extraordinary items either year. required: 1.prepare the journal entry to record the change in accounting principle. (if no entry is required for a particular event, select "no journal entry required" in the first account field.)2. prepare the 2013–2012 comparative income statements beginning with income from continuing operations. include per share amounts. (round eps answers to 2 decimal places.) comparative income statements 2013 2013 earnings per common share

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 19:30, kenz2797

Nextdoor is an instant messaging application for smartphones. new smartphone users find it easier to connect with friends and relatives through this mobile app when compared to other similar instant messaging applications. hence, it has the largest user base in the industry. thus, nextdoor app's value has increased primarily due to itsa. learning curve effects. b. economies of scale. c. economies of scope. d. network effects.

Answers: 2

Business, 22.06.2019 23:00, infoneetusinghoyg22o

To increase sales, robert sends out a newsletter to his customers each month, letting them know about new products and ways in which to use them. in order to protect his customers' privacy, he uses this field when addressing his e-mail. attach bcc forward to

Answers: 2

Business, 22.06.2019 23:40, coreycbg1127

Joint cost cheyenne, inc. produces three products from a common input. the joint costs for a typical quarter follow: direct materials $45,000 direct labor 55,000 overhead 60,000 the revenues from each product are as follows: product a $75,000 product b 80,000 product c 30,000 management is considering processing product a beyond the split-off point, which would increase the sales value of product a to $116,000. however, to process product a further means that the company must rent some special equipment costing $17,500 per quarter. additional materials and labor also needed would cost $12,650 per quarter. a. what is the gross profit currently being earned by the three products for one quarter? $answer b. what is the effect on quarterly profits if the company decides to process product a further? $answer

Answers: 2

Do you know the correct answer?

The cecil-booker vending company changed its method of valuing inventory from the average cost metho...

Questions in other subjects:

History, 29.01.2021 05:20

Mathematics, 29.01.2021 05:20

Mathematics, 29.01.2021 05:20

Social Studies, 29.01.2021 05:20

History, 29.01.2021 05:20

Mathematics, 29.01.2021 05:20