Business, 09.12.2019 20:31, smithad382

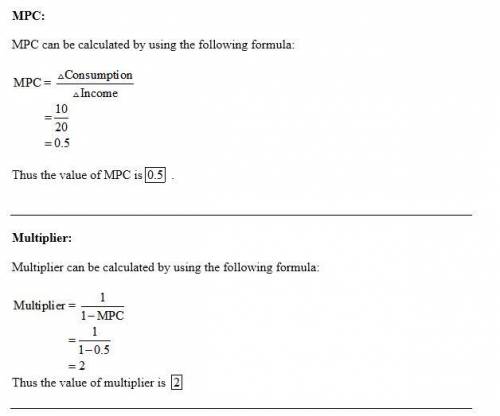

Suppose that an initial $20 billion increase in investment spending expands gdp by $20 billion in the first round of the multiplier process. if gdp and consumption both rise by $10billion in the second round of the process, what is the mpc in this economy?

instructions: round your answer to one decimal place

mpc = $

what is the size of the multiplier?

instructions: round your answer to one decimal place

the multiplier = $

if, instead, gdp and consumption both rose by $12 billion in the second round, what would have been the size of the multiplier?

instructions: round your answer to one decimal place

the multiplier = $

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:40, muhammadcorley123456

Anew equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. the investment cost is $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. increased productivity attributable to the equipment will amount to $10,000 per year after operating costs have been subtracted from the revenue generated by the additional production. if marr is 10%, is investing in this equipment feasible? use annual worth method.

Answers: 3

Business, 22.06.2019 17:50, nayelieangueira

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 22.06.2019 23:30, ameliaxbowen7

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

Business, 23.06.2019 04:20, hardwick744

What common business mistake can cost you everything

Answers: 1

Do you know the correct answer?

Suppose that an initial $20 billion increase in investment spending expands gdp by $20 billion in th...

Questions in other subjects:

Mathematics, 07.09.2020 01:01

Geography, 07.09.2020 01:01

Social Studies, 07.09.2020 01:01

Mathematics, 07.09.2020 01:01