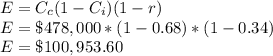

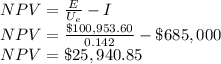

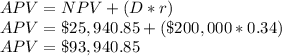

Joshua industries is considering a new project with cash inflows of $478,000 for the indefinite future. cash costs are 68 percent of the cash inflows. the initial cost of the investment is $685,000. the tax rate is 34 percent and the unlevered cost of equity is 14.2 percent. the firm is financing $200,000 of the project cost with debt. what is the adjusted present value of the project?

a. $102,429.67

b. $98,311.16

c. $32,408.18

d. $93,940.85

Answers: 2

Similar questions

Business, 26.08.2019 22:30, guardhic7165

Answers: 2

Business, 27.08.2019 01:30, kathrynaveda

Answers: 2

Business, 25.11.2019 20:31, shanayamcinnis15

Answers: 2

Business, 05.12.2019 17:31, kieramacphee6216

Answers: 1

Do you know the correct answer?

Joshua industries is considering a new project with cash inflows of $478,000 for the indefinite futu...

Questions in other subjects:

Mathematics, 09.10.2021 15:10

Mathematics, 09.10.2021 15:10

World Languages, 09.10.2021 15:10

History, 09.10.2021 15:10

Mathematics, 09.10.2021 15:10