Business, 06.12.2019 22:31, liyahheadhigh

Only one firm produces and sells soccer balls in the country of wiknam, and as the story begins, international trade in soccer balls is prohibited. the following equations describe the monopolist’s demand, marginal revenue, total cost, and marginal cost:

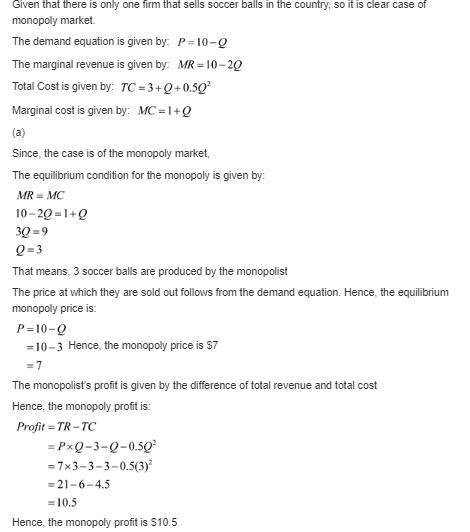

demand: p = 10 – q

marginal revenue: mr = 10 – 2q

total cost: tc = 3 + q + 0.5 q^2

marginal cost: mc = 1 + q

where q is quantity and p is the price measured in wiknamian dollars.

a. how many soccer balls does the monopolist produce? at what price are they sold? what is the monopolist’s profit?

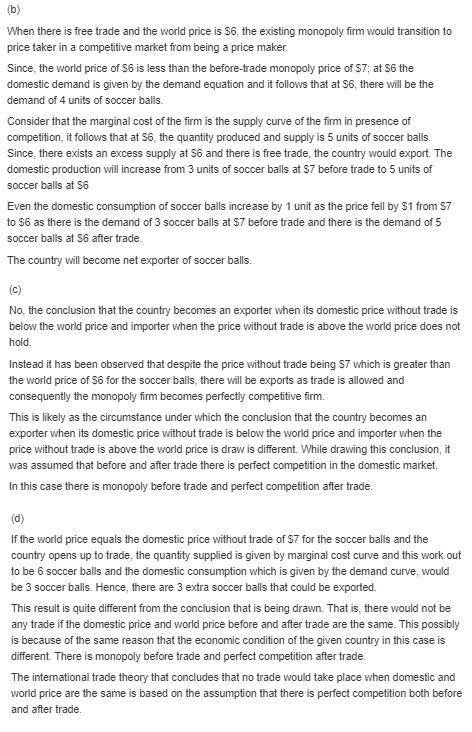

b. one day, the king of wiknam decrees that henceforth there will be free trade—either imports or exports— of soccer balls at the world price of $6. the firm is now a price taker. what happens to domestic production of soccer balls? to domestic consumption? does wiknam export or import soccer balls?

c. in our analysis of international trade in chapter 9, a country becomes an exporter when the price without trade is below the world price and an importer when the price without trade is above the world price. does that conclusion hold in your answers to parts (a) and (b)? explain.

d. suppose that the world price was not $6 but, instead, happened to be exactly the same as the domestic price without trade as determined in part (a). would anything have changed when trade was permitted? explain.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 00:00, billey32

Exercise 4-6 the following balances were taken from the books of alonzo corp. on december 31, 2017. interest revenue $86,000 accumulated depreciation—equipment $40,000 cash 51,000 accumulated depreciation—buildings 28,000 sales revenue 1,380,000 notes receivable 155,000 accounts receivable 150,000 selling expenses 194,000 prepaid insurance 20,000 accounts payable 170,000 sales returns and allowances 150,000 bonds payable 100,000 allowance for doubtful accounts 7,000 administrative and general expenses 97,000 sales discounts 45,000 accrued liabilities 32,000 land 100,000 interest expense 60,000 equipment 200,000 notes payable 100,000 buildings 140,000 loss from earthquake damage 150,000 cost of goods sold 621,000 common stock 500,000 retained earnings 21,000 assume the total effective tax rate on all items is 34%. prepare a multiple-step income statement; 100,000 shares of common stock were outstanding during the year. (round earnings per share to 2 decimal places, e. g. 1.48.)

Answers: 2

Business, 22.06.2019 03:40, levicorey846

2. the language of price controls consider the market for rental cars. suppose that, in a competitive market without government regulations, the equilibrium price of rental cars is $58 per day, and employees at car rental companies earn $19.50 per hour. complete the following table by indicating whether each of the statements is an example of a price ceiling or a price floor and whether it results in a shortage or a surplus or has no effect on the price and quantity that prevail in the market. statement price control effect there are many teenagers who would like to work at car rental companies, but the minimum-wage law sets the hourly wage at $23.00. the government has instituted a legal minimum price of $87 per day for rental cars. the government prohibits car rental companies from renting out rental cars for more than $87 per day.

Answers: 2

Business, 22.06.2019 06:40, anatomyfl

At april 1, 2019, the food and drug administration is in the process of investigating allegations of false marketing claims by hulkly muscle supplements. the fda has not yet proposed a penalty assessment. hulkly’s fiscal year ends on december 31, 2018. the company’s financial statements are issued in april 2019. required: for each of the following scenarios, determine the appropriate way to report the situation. 1. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 2. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is probable. 3. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 4. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is probable.

Answers: 1

Business, 22.06.2019 09:40, nessross1018

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Do you know the correct answer?

Only one firm produces and sells soccer balls in the country of wiknam, and as the story begins, int...

Questions in other subjects:

Social Studies, 07.07.2019 20:40

Social Studies, 07.07.2019 20:40

History, 07.07.2019 20:40

Biology, 07.07.2019 20:40

History, 07.07.2019 20:40