Business, 06.12.2019 20:31, hnsanders00

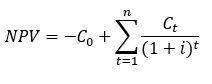

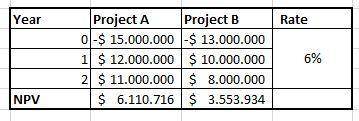

Consider two projects: project a currently costs $15 million, which is to be paid this year. the returns are $12 million after in one year and $11 million in two years. project b currently costs $13 million, again to be paid this year. the returns are $10 million after in one year and $8 million in two years.

at an interest rate of 6%, the net present value of project a is roughly , while the net present value of project b is roughly .

suppose investing in one project eliminates the opportunity to invest in the other. if the interest rate is 6%, project is preferable.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:00, chancegodwin5

In a small group, members have taken on the task roles of information giver, critic/analyzer, and recorder, and the maintenance roles of gatekeeper and follower. they need to fulfill one more role. which of the following would be most effective for their group dynamics? a dominator b coordinator c opinion seeker d harmonizer

Answers: 1

Business, 22.06.2019 19:20, cathydaves

Bcorporation, a merchandising company, reported the following results for october: sales $ 490,000 cost of goods sold (all variable) $ 169,700 total variable selling expense $ 24,200 total fixed selling expense $ 21,700 total variable administrative expense $ 13,200 total fixed administrative expense $ 33,600 the contribution margin for october is:

Answers: 1

Business, 22.06.2019 20:00, krystynas799

In myanmar, six laborers, each making the equivalent of $ 2.50 per day, can produce 40 units per day. in china, ten laborers, each making the equivalent of $ 2.25 per day, can produce 48 units. in billings comma montana, two laborers, each making $ 60.00 per day, can make 102 units. based on labor cost per unit only, the most economical location to produce the item is china , with a labor cost per unit of $ . 05. (enter your response rounded to two decimal places.)

Answers: 3

Business, 23.06.2019 08:20, lalaboooobooo

Marque a alternativa que apresenta somente as opções de financiamento com recursos internos: a) lucros, venda de ativos e recursos próprios. b) lucros, venda de ativos e redução no capital de giro. c) lucros, venda de ativos e recursos de familiares. d) lucros, venda de ativos e prorrogação nos prazos para receber os pagamentos dos clientes. e) lucros, venda de ativos e aumento do estoque de mercadorias.

Answers: 1

Do you know the correct answer?

Consider two projects: project a currently costs $15 million, which is to be paid this year. the re...

Questions in other subjects:

Mathematics, 22.03.2021 01:40

Mathematics, 22.03.2021 01:40

Physics, 22.03.2021 01:40

Social Studies, 22.03.2021 01:40